Do Foreign Corporations Get A 1099

You should get a form W-8BEN signed by the foreign contractor. Any person making more than 600 per year is issued a 1099-MISC for income earned in the US.

Filing 1099s Who Gets One Capforge

Filing 1099s Who Gets One Capforge

For instance a foreign corporation may be required to file Forms 1096 and 1099 were applicable just as domestic corporations are so required.

Do foreign corporations get a 1099. A foreign corporation is a qualified foreign corporation if it meets any of the following conditions. Scholarship or fellowship grants that are taxable to the recipient because they are paid for teaching research or other services as a condition for. Self-employed via internet- For businesses hiring foreign individuals for work remotely or over the internet a Form 1099 is not required.

Financial institution if the foreign branch is a qualified intermediary Any other person that is not a US. Each Form 1099-DIV should be. Most payments to incorporated businesses do not require that.

As long as the foreign contractor is not a US. However they are not specific about foreign entities on that form. You made the payment to someone who is not your employee.

How to report dividends from a foreign brokerage account when there is no 1099-DIV. There are a variety of US. In addition to the requirement to file a US.

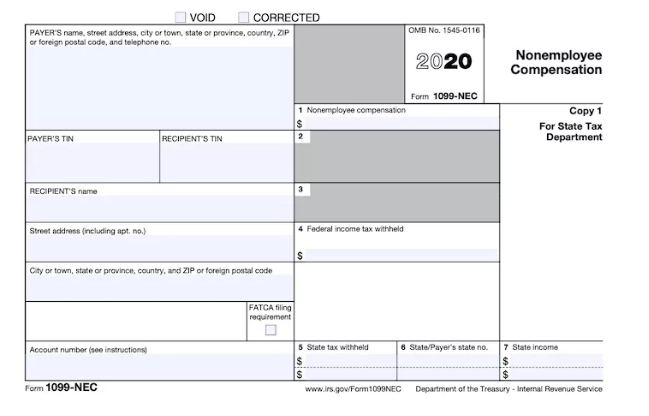

If you pay independent contractors you may have to file Form 1099-NEC Nonemployee Compensation to report payments for services performed for your trade or business. And who are also citizens of the country. The IRS is in the process of enforcing compliance of long-standing rules requiring US.

Form 1099-DIV is a form sent to investors who have received distributions from any type of investment during a calendar year. Investors can receive multiple 1099-DIVs. However in the US.

To whom you paid amounts reportable in boxes 1 3 and 8 of at least 10. If your independent worker completes all tasks in hisher country of origin and receives compensation via PayPal a Form 1099 is also not necessary. Corporate income tax return just like domestic corporations foreign corporations may be required to file information returns.

However foreign corporations are not issued this document. A 1099 is normally issued to individuals living in the US. File Form 1099-INT for each person.

Foreign worker providing services inside the US- It is vital for tax purposes to monitor where services are. You only issue 1099s to non-corporate entities contractors consultants some LLPs and similar entities - read the specifics on the form that are US. The dividend will be qualified if the foreign corporation is a qualified by itself.

The Form W-8BEN certifies that the foreign contractor is not a US. No the IRS rules regarding Form 1099-MISC do not apply to foreign entities operating outside the US. Nonresident alien individual Foreign corporation or partnership Foreign trust or estate Foreign government Foreign branch of a US.

Taxpayer and all of the contracted services were performed outside the US a Form 1099 is not required. Information reporting requirements potentially applicable to foreign corporations. For example a foreign corporation may be required to file Form 1099 to report the payment of certain amounts such as interest or dividends.

So you dont have to complete 1099s for non-US. By signing Form W-8BEN the foreign contractor is certifying that he or she is not a US. Reportable payments to corporations.

Or The foreign corporation first became a surrogate foreign corporation as defined in section 7874a2B after December 22 2017 but is not treated as a domestic corporation under. If the following four conditions are met you must generally report a payment as nonemployee compensation. Do not use Form 1099-MISC to report scholarship or fellowship grants.

Person and the services are wholly performed outside the US then no Form 1099 is required and no withholding is required. The foreign corporation is a passive foreign investment company as defined in section 1297 for the tax year in which the dividend was paid or the prior year. For whom you withheld and paid any foreign tax on interest.

Tax withholding on US-source income payments to nonresident aliens and foreign entities collectively foreign personsAs a result foreign vendors are being asked by their clients to provide them with a US. In addition to issuing 1099-MISCs to all applicable companies businesses must also issue 1099-Bs to any companies foreign or domestic. Forms 1099-A and 1099-C.

From whom you withheld and did not refund any federal income tax under the backup withholding rules regardless of the amount of the payment. If the foreign contractor is not a US. Do foreign entities in business with us firms consulting outfits have to issue form 1099.

Instead you will need to ask the contractor to complete a Form W-8BEN. Tax purposes or to request an. Withholding certificate to document their foreign status for US.

However a foreign-based company with an office in the US would be required to prepare 1099-MISC under the IRS rules. Corporations The major exception to the 1099 requirement is payments to corporations.

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Quickbooks 1099 W2 Mate Adds Ability To Email Quickbooks 1099 Forms Tax Forms Irs Forms 1099 Tax Form

Quickbooks 1099 W2 Mate Adds Ability To Email Quickbooks 1099 Forms Tax Forms Irs Forms 1099 Tax Form

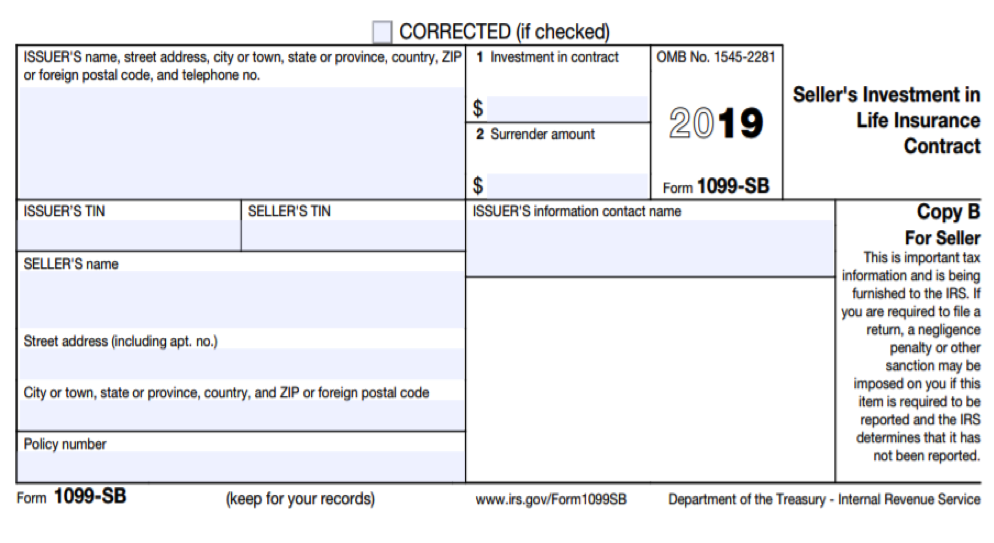

Form 1099 Sb Seller S Investment In Life Insurance Contract Irs Compliance

Form 1099 Sb Seller S Investment In Life Insurance Contract Irs Compliance

Do I Have To Prepare A 1099 Nec For A Foreign Contractor Amy Northard Cpa The Accountant For Creatives

Do I Have To Prepare A 1099 Nec For A Foreign Contractor Amy Northard Cpa The Accountant For Creatives

Efile 1099 Misc 1099 Div 1099 Int For Business Onlinefiletaxes File 1099 Misc Forms Online Irs 1099 Miscellaneou Irs Tax Forms Income Tax 1099 Tax Form

Efile 1099 Misc 1099 Div 1099 Int For Business Onlinefiletaxes File 1099 Misc Forms Online Irs 1099 Miscellaneou Irs Tax Forms Income Tax 1099 Tax Form

Five Things You Need To Know About Form 5471 Filing Taxes Accounting Accounting Services

Five Things You Need To Know About Form 5471 Filing Taxes Accounting Accounting Services

Interest Income Form 1099 Int What Is It Do You Need It

Interest Income Form 1099 Int What Is It Do You Need It

Form 1099 Requirements For Foreign Workers A Klr Global Tax Blog Article Blog Article Worker Quickbooks

Form 1099 Requirements For Foreign Workers A Klr Global Tax Blog Article Blog Article Worker Quickbooks

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

What Is A 1099 C Form And Why Did I Get It Credit Repair Services What Is A 1099 Credit Education

What Is A 1099 C Form And Why Did I Get It Credit Repair Services What Is A 1099 Credit Education

Do I Need To File 1099s Deb Evans Tax Company

Do I Need To File 1099s Deb Evans Tax Company

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Filing Form 1099 Nec Beginning In Tax Year 2020 Leone Mcdonnell Roberts Professional Association Certified Public Accountants

:max_bytes(150000):strip_icc()/1099g-e5f0e0c9527f418cbd1005d396f6218e.jpg) Form 1099 G Certain Government Payments Definition

Form 1099 G Certain Government Payments Definition

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Form 1099 Misc Requirements Deadlines And Penalties Efile360

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Requirements Deadlines And Penalties Efile360

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

How To Fill Out A 1099 Nec Box By Box Guide On Filling Out The Form

Downloadable 1099 Tax Forms Printable 1099 Form 2018 Word Image 510 Printable Pages 1099 Tax Form Business Letter Template Simple Cover Letter Template

Downloadable 1099 Tax Forms Printable 1099 Form 2018 Word Image 510 Printable Pages 1099 Tax Form Business Letter Template Simple Cover Letter Template