Business Income From Dependent Properties - Broad Form

Schedule of locations covered. Additional coverage - business income from dependent properties.

Federal Register Compliance Requirements For Commodity Pool Operators On Form Cpo Pqr

Federal Register Compliance Requirements For Commodity Pool Operators On Form Cpo Pqr

Business Income from Dependent Properties Limited Form CP 15 09 These endorsements are used to provide coverage for loss of business income due to the necessary suspension of the insureds operations as a result of loss by a covered cause of loss to dependent property.

Business income from dependent properties - broad form. The dependent property form contains two definitions that. BUSINESS INCOME AND EXTRA EXPENSE COVERAGE FORM BUSINESS INCOME WITHOUT EXTRA EXPENSE COVERAGE FORM SCHEDULE Name And Describe Occupancy And Location. COVERAGE We will pay for the actual loss of Business Income you sustain due to the necessary suspension of your operations during the period of restoration.

Business income coverage BIC form is a type of property insurance policy which covers a companys loss of income due to a slowdown or temporary suspension of normal operations which stem from. We will pay for the actual loss of Business Income you sustain due to the necessary suspension of your operations during the period of restoration. Business Income from Dependent Properties Broad Form CP 15 08.

Business Income from Dependent Properties. Broad form commercial property coverage form designed for insureds whose business income is dependent on the ongoing operations of other businesses they do not own Contributing Location Businesses who support insured by providing merchandise or materials. The contingent property may be specifically named or the coverage may blanket all customers and suppliers.

For example the ISO Business Income from Dependent Properties Broad Form CP 15 08 06 07 2006 provides coverage for the loss of business income incurred when the insured sustains a suspension of operations during the period of restoration that is caused by a covered direct physical loss of or damage to dependent property. CBI insurance is also known as contingent business income insurance or dependent properties insurance. This endorsement extends business income and extra expense if the CP 00 30 is used to dependent property losses emanating from any of the four types of dependent properties suppliers buyers providers andor drivers.

BUSINESS INCOME AND EXTRA EXPENSE COVERAGE FORM BUSINESS INCOME WITHOU-r EXTRA EXPENSE COVERAGE FORM SCHEDULE Name and Describe Occupancy and Location Contributing Locations. Business Income from Dependent Properties - Broad Form CP 15 08. We hope the you have a better understanding of the meaning of Business Income From Dependent Properties.

Sometimes the term contingent time element is used when discussing both CBI and contingent extra expense. The Business Income from Dependent Properties portion of your property policy provides insurance coverage in the event the damage or destruction of non-owned property reduces or terminates the insureds earnings. Form that provides insurance coverage for the insured in the event the damage or destruction of non-owned property reduces or terminates the insureds earnings.

Coverage with respect to dependent property is replaced by the following. The suspension must be caused by direct physi-cal loss of or damage to dependent property at a. The entire business income and extra expense limit of coverage is available to pay the loss resulting from the dependent propertys.

This endorsement modifies insurance provided under the following. - Business income From Dependent Properties - Broad Form- CP15081012 - Business Income From Dependent Properties - Limited International Coverage- CP15011012 Describe and apply the Extra Expense Coverage provided under the Business Income And Extra Expense Coverage Form. Difference in conditions coverage form und 1211 additional coverage - business income and extra expense und 1206 additional coverage - business income without extra expense und 1207.

Dependent properties business income or extra expense coverage provides coverage for the insureds income or expense loss resulting from damage by a covered cause to property of another business on which the insured depends to purchase the insureds good and services to supply materials or services to the insured or to attract customers to the insureds business. BUSINESS INCOME FROM DEPENDENT PROPERTIES LIMITED INTERNATIONAL COVERAGE This endorsement modifies insurance provided under the following. For example if the insured manufactures plastic airplane kits and the supplier of the plastic for making the airplanes has a catastrophic fire at its plant the manufacturer would not be able to continue to.

Posted by Scott Brookes. Business Income coverage can be extended to include the loss of business income that results from damage to or destruction of a dependent property by attachment of one of two endorsements. Business Income From Dependent Properties Broad form commercial property coverage form designed for insureds whose business income is dependent on the ongoing operations of other businesses they do not own.

Dependent properties business income form. COVERAGE LANGUAGE ISOs Business Income from Dependent Properties-Broad Form contains the following grant of coverage. Or Business Income From Dependent Properties - Limited Form CP 15 09.

CP 15 55 06 95 Business Income Changes - Time Period CP 15 08 04 02 Business Income from Dependent Properties - Broad Form CP 15 09 04 02 Business Income from Dependent Properties - Limited Form CP 15 20 06 95 Business Income Premium Adjustment CP 15 15 06 95 Business Income ReportWork Sheet IL 00 03 07 02 Calculation of Premium. CP 15 08 06 07 ISO Properties Inc 2006 Page 1 of 2 BUSINESS INCOME FROM DEPENDENT PROPERTIES BROAD FORM This endorsement modifies insurance provided under the following. Business Income From Dependent Properties - Broad Form CP 15 08.

Dependent property coverage extends to protect the insured from business income losses emanating from the.

Form 5695 Instructions Claiming The Solar Tax Credit Energysage

Federal Register Compliance Requirements For Commodity Pool Operators On Form Cpo Pqr

Federal Register Compliance Requirements For Commodity Pool Operators On Form Cpo Pqr

Federal Register Taxable Year Of Income Inclusion Under An Accrual Method Of Accounting

Federal Register Taxable Year Of Income Inclusion Under An Accrual Method Of Accounting

Publication 974 2019 Premium Tax Credit Ptc Internal Revenue Service

Publication 974 2019 Premium Tax Credit Ptc Internal Revenue Service

3 21 110 Processing Form 1042 Withholding Returns Internal Revenue Service

3 21 110 Processing Form 1042 Withholding Returns Internal Revenue Service

Publication 570 2020 Tax Guide For Individuals With Income From U S Possessions Internal Revenue Service

Publication 570 2020 Tax Guide For Individuals With Income From U S Possessions Internal Revenue Service

A Complete 2020 Guide To Cryptocurrency Taxes Taxbit

A Complete 2020 Guide To Cryptocurrency Taxes Taxbit

Federal Register Amendments To Compliance Requirements For Commodity Pool Operators On Form Cpo Pqr

Federal Register Amendments To Compliance Requirements For Commodity Pool Operators On Form Cpo Pqr

Pin On A Los Angeles Padres Diego San Francisco Diablo

Pin On A Los Angeles Padres Diego San Francisco Diablo

Registered Domestic Partners And Company Defined Domestic Partners Abd Insurance Financial Services

Registered Domestic Partners And Company Defined Domestic Partners Abd Insurance Financial Services

Publication 570 2020 Tax Guide For Individuals With Income From U S Possessions Internal Revenue Service

Publication 570 2020 Tax Guide For Individuals With Income From U S Possessions Internal Revenue Service

3 21 110 Processing Form 1042 Withholding Returns Internal Revenue Service

3 21 110 Processing Form 1042 Withholding Returns Internal Revenue Service

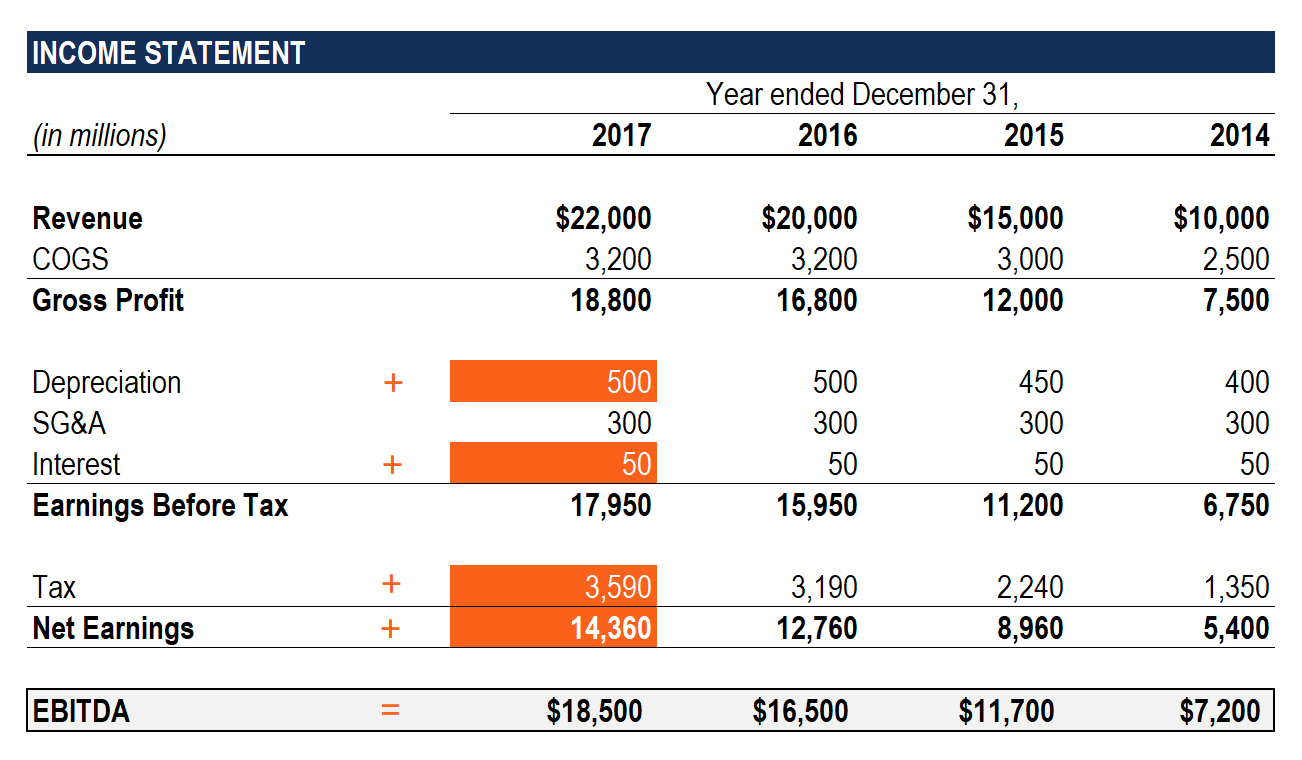

What Is Ebitda Formula Definition And Explanation

What Is Ebitda Formula Definition And Explanation

Tackling The Tax Code Efficient And Equitable Ways To Raise Revenue

Tackling The Tax Code Efficient And Equitable Ways To Raise Revenue

3 21 110 Processing Form 1042 Withholding Returns Internal Revenue Service

3 21 110 Processing Form 1042 Withholding Returns Internal Revenue Service

3 21 110 Processing Form 1042 Withholding Returns Internal Revenue Service

3 21 110 Processing Form 1042 Withholding Returns Internal Revenue Service

Federal Register Amendments To Compliance Requirements For Commodity Pool Operators On Form Cpo Pqr

Federal Register Amendments To Compliance Requirements For Commodity Pool Operators On Form Cpo Pqr

Federal Register Amendments To Compliance Requirements For Commodity Pool Operators On Form Cpo Pqr

Federal Register Amendments To Compliance Requirements For Commodity Pool Operators On Form Cpo Pqr

/dotdash_Final_Trust_Aug_2020-01-6b0686cb892a40589605baeeef79a183.jpg)