Small Business Administration Economic Injury Disaster Loan Program Florida

Starting the week of Tuesday April 6 the SBA raised the loan limit for the COVID-19 EIDL program from 6-months of economic injury with. This is not a Federal or Small Business Administration loan.

Sba Provided 20 Billion To Small Businesses And Non Profits Through The Economic Injury Disaster Loan Advance Program Pointofsale Com

Sba Provided 20 Billion To Small Businesses And Non Profits Through The Economic Injury Disaster Loan Advance Program Pointofsale Com

19 hours agoTo further meet the needs of US.

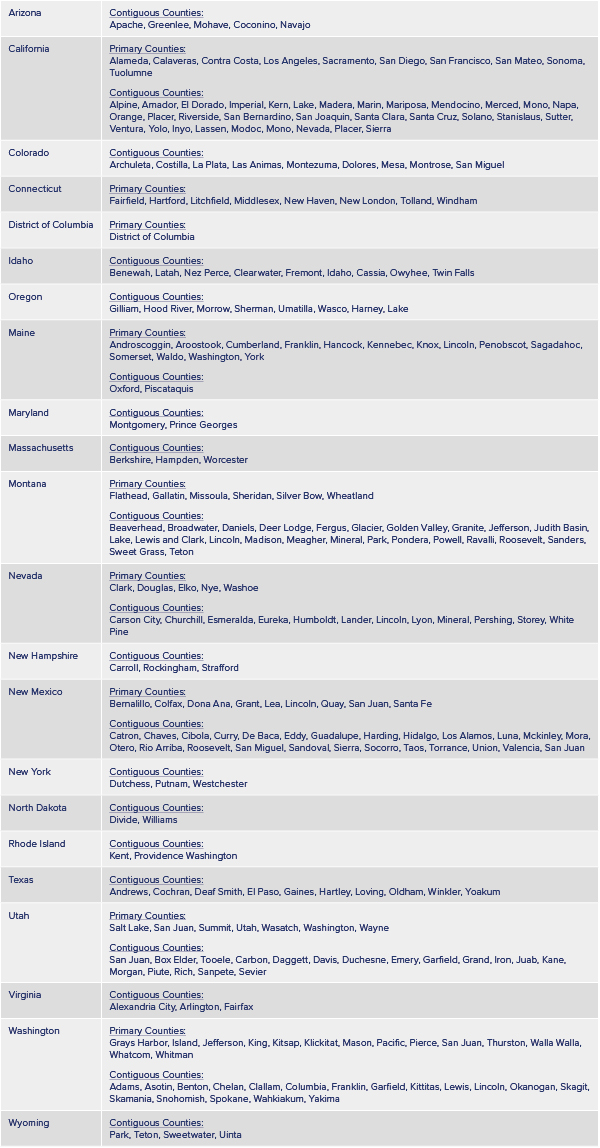

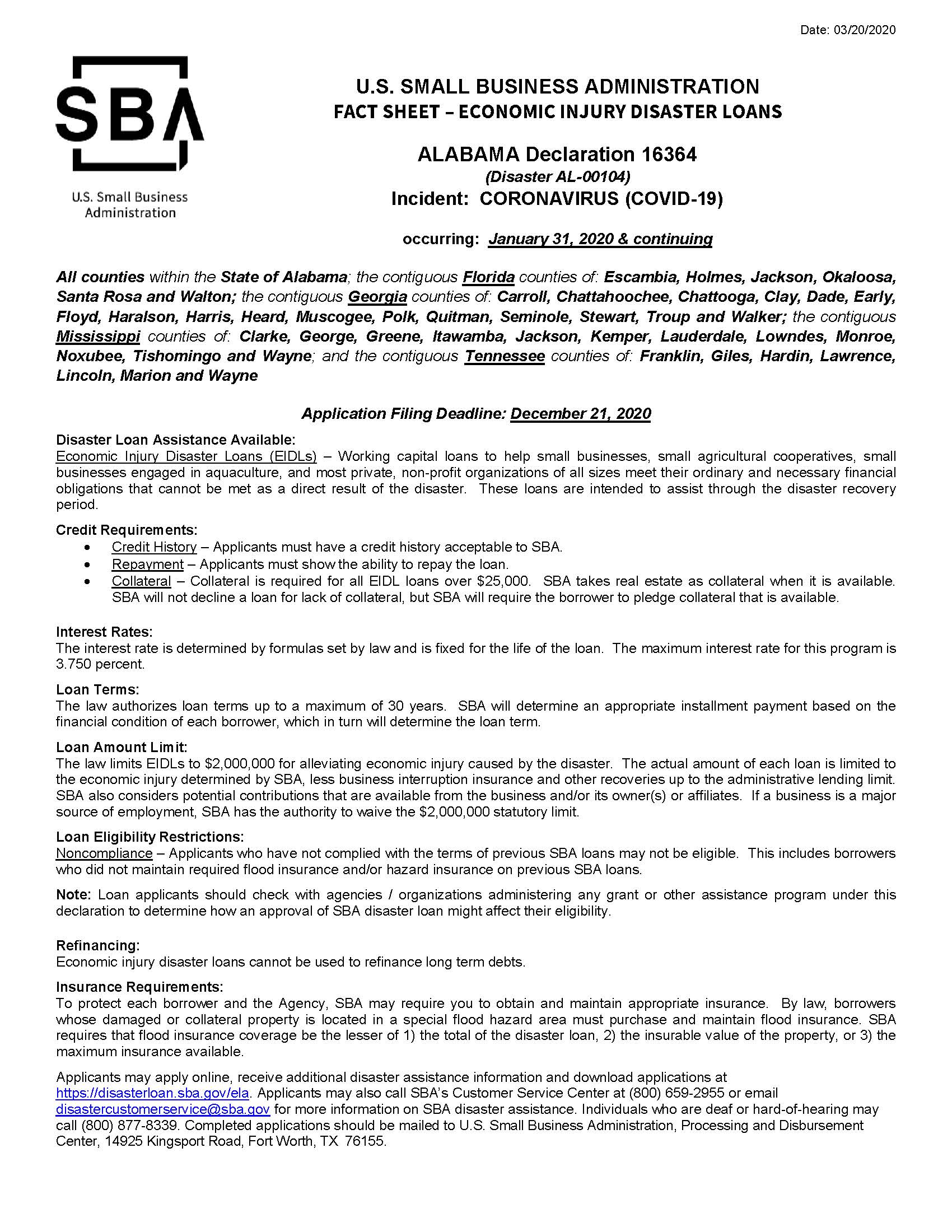

Small business administration economic injury disaster loan program florida. For loans approved starting the week of April 6 2021. The Small Business Administration released data on every small business that received a Paycheck Protection Program or Economic Injury Disaster Loan. SBA acted under its own authority as provided by the Coronavirus Preparedness and Response Supplemental Appropriations.

For current SBA Serviced Disaster Home and Business Loans if your disaster loan was in regular servicing status on March 1 2020 the SBA is providing automatic deferments through December 31 2020. Starting the week of April 6 the SBA is raising the loan limit for the COVID-19 EIDL program from six months of economic injury with a maximum loan. SBA can provide up to 2 million to help meet financial obligations and operating expenses that could have been met had the disaster not occurred.

The SBA offers disaster assistance in the form of low interest loans to businesses nonprofit organizations homeowners and renters located in regions affected by declared disasters. Small Business Administration is offering low-interest federal disaster loans for working capital to Florida small businesses suffering substantial economic injury as a result of the Coronavirus COVID-19 SBA Administrator Jovita Carranza announced today. Economic Injury Disaster Loans EIDLs Working capital loans to help small businesses small agricultural cooperatives small businesses engaged in aquaculture and most private non-profit organizations of all sizes meet their ordinary and necessary financial.

SBA also provides eligible small businesses and nonprofit organizations with working capital to help overcome the economic injury of a declared disaster. Small business emergency bridge loan. The Florida SBDC Network and our state and federal partners remain committed to helping you access the disaster capital and resources your business needs to recover rebuild and grow.

Dislocated worker grant program. On March 24 2021 SBA announced that starting the week of April 6 2021 the SBA is raising the loan limit for the COVID-19 EIDL program from 6-months of economic injury with a maximum loan amount of 150000 to up to 24-months of economic. The Florida Small Business Emergency Bridge Loan Program was first activated following Hurricane Andrew.

Evacuation and curfew reports. The data was released after months of. The loan amount will be based on your actual economic injury and your companys financial needs regardless of.

SBAs Office of Disaster Assistance will coordinate with the states or territorys Governor to submit the request for Economic Injury Disaster. Small Business Administration reopened the economic injury disaster loan EIDL and EIDL advance program portal to all. For loans approved prior to the week of April 6 2021 see loan increases.

Continuation of health care benefits rent utilities fixed debt payments. Vacation solicited the assistance of another individual to defraud the Small Business Administration by fraudulently seeking CARES Act Economic Injury Disaster Loans a program which provides economic relief to small businesses that have experienced a temporary loss. Business damage assessment survey.

Learn more about this debt relief program by clicking here. It has been activated 13 additional times following disasters and has helped more than 2670 small businesses statewide to receive more than 63 million in assistance. Small Business Administration SBA loans Economic Injury Disaster Loans EIDLs and other federal stimulus programs are your only options for getting small business disaster relief to help you get through the COVID-19 crisis.

The EIDL program is designed to provide economic relief to businesses that are currently experiencing a temporary loss of revenue due to coronavirus COVID-19. Think the Cares Act Paycheck Protection Program PPP loans US. Who can use an SBA disaster loan.

Agricultural business with 500 or fewer employees that has suffered substantial. From Lake County Examiner Lakeview OR US. It is also alleged in the indictment that Hilaire using the moniker Mr.

ATLANTA The US. 24-months of economic injury with a maximum loan amount of 500000. SBA disaster loans and emergency grants are back.

Small businesses and nonprofits the US. Any such Economic Injury Disaster Loan assistance declaration issued by the SBA makes loans available to small businesses and private non-profit organizations in designated areas of a state or territory to help alleviate economic injury caused by the Coronavirus COVID-19. ATLANTA Small businesses small agricultural cooperatives small businesses engaged in aquaculture and most private nonprofit organizations located in the declared counties of Florida that have suffered financial losses as the result of Hurricane Irma should consider applying for an Economic Injury Disaster Loan from the US.

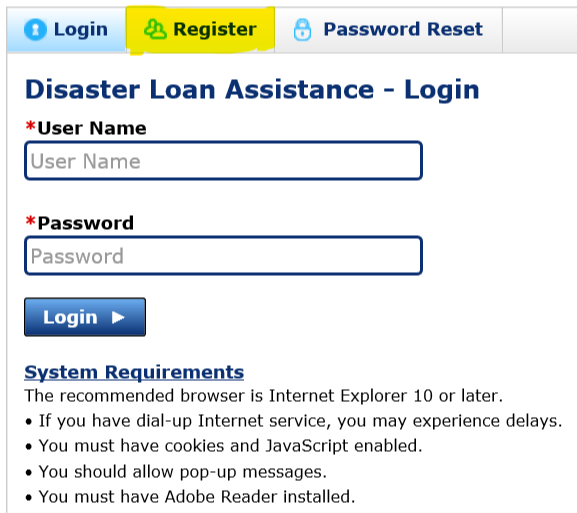

Heres what small businesses need to know The Small Business Administration is reopening its Economic Injury Disaster Loans or EDIL program. Following you will find information on federal disaster assistance and other resources available to you including an overview of disaster relief available through the Economic Aid Act other public and private sector. If you are a small business nonprofit organization of any size or a US.

Small Business Administration is increasing the maximum amount small businesses and non-profit organizations can borrow through its COVID-19 Economic Injury Disaster Loan EIDL program.

Coronavirus Resources For Small Businesses U S Representative Mike Waltz

Coronavirus Resources For Small Businesses U S Representative Mike Waltz

Https Www Sba Gov Sites Default Files Files Resourceguide 2822 Pdf

Coronavirus Covid 19 Small Business Guidance Loan Resources Greater Miami Chamber Of Commerce

Coronavirus Covid 19 Small Business Guidance Loan Resources Greater Miami Chamber Of Commerce

Https Www Sba Gov Sites Default Files Fl 14614 Fact Sheet 1 Pdf

Coronavirus Resources For Small Businesses U S Representative Mike Waltz

Coronavirus Resources For Small Businesses U S Representative Mike Waltz

Coronavirus Resources For Small Businesses U S Representative Mike Waltz

Coronavirus Resources For Small Businesses U S Representative Mike Waltz

Updated The Economic Injury Disaster Loan Eidl Program Vs The Paycheck Protection Program Ppp Comparison Chart Krost

Updated The Economic Injury Disaster Loan Eidl Program Vs The Paycheck Protection Program Ppp Comparison Chart Krost

Small Business Administration Sba Offers Low Interest Disaster Loans To Businesses Residents Affected By May 26 27 Flash Flooding City Of Sunny Isles Beach

Small Business Administration Sba Offers Low Interest Disaster Loans To Businesses Residents Affected By May 26 27 Flash Flooding City Of Sunny Isles Beach

Sba S Economic Injury Disaster Loan Program

Sba S Economic Injury Disaster Loan Program

Sba S Disaster Loans Are Helping Businesses And Residents Now Top 11 Million In Florida For Hurricane Sally Damage Frla

Sba S Disaster Loans Are Helping Businesses And Residents Now Top 11 Million In Florida For Hurricane Sally Damage Frla

Gov Ivey Small Businesses Impacted By Covid 19 Eligible For Assistance

Gov Ivey Small Businesses Impacted By Covid 19 Eligible For Assistance

Economic Injury Disaster Loan Eidl Working Session How To Apply Live Q A 6 19 20 Self Made

Economic Injury Disaster Loan Eidl Working Session How To Apply Live Q A 6 19 20 Self Made

Coronavirus Resources For Small Businesses U S Representative Mike Waltz

Coronavirus Resources For Small Businesses U S Representative Mike Waltz

Small Business Financial Assistance The Chamber Of Commerce Of West Alabama

Small Business Financial Assistance The Chamber Of Commerce Of West Alabama

Sba To Increase Lending Limit For Covid 19 Economic Injury Disaster Loans Edc

Sba To Increase Lending Limit For Covid 19 Economic Injury Disaster Loans Edc

Https Www Sba Gov Sites Default Files Files Resourceguide 2822 Pdf

Sba S Economic Injury Disaster Loan Program

Sba S Economic Injury Disaster Loan Program

Https Www Sba Gov Sites Default Files 2018 11 Sba 20fy 202018 20afr Pdf

Plantation Florida Lawyers Light Gonzalez Pllc

Plantation Florida Lawyers Light Gonzalez Pllc