How To Get My 1099 Form From Postmates

It will look something like this. Postmates Tax Form 1099.

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

I have used the online TurboTax for years but this year Credit Karma is offering free online tax filing for the first time.

How to get my 1099 form from postmates. The only one who can give you your 1099 is the company you work for. From there youll input your total business profit on the Schedule SE which will determine how much in taxes youll pay on your independent income. So lets talk about 1099s today.

I love using TurboTax because its so easy but once you start doing tax returns that arent the standard 1040 form it starts to get expensive. Generally when you receive income outside of your usual paycheck youll also get a tax form summarizing your earnings. Postmates whove earned 600 or more in a year will receive a Form 1099-MISC which reports your annual earnings.

Typically you should receive your 1099 form before January 31 2021. To get your tax forms digitally. Posted by 3 years ago.

Well get into that in a bit. Usually 1099-K is something. Didnt get a 1099.

Weve put together a list of the 6 fastest ways to get in touch with Uber here and the six best ways to. As a general rule if you make more than 600 in a calendar year Postmates will usually send you a Form 1099. Uber and Lyft send out 1099 forms every year by January 31.

If you have not received your 1099 form from Uber or Lyft you may need to reach out to Uber and Lyft to get those forms. Need help contacting Postmates for my 1099 to file my taxes. I did not receive the 1099-MISC form.

Also on the Schedule C youll mark what expenses you want to claim as deductions. Before I go any further let me make this clear. Youll want to have this available when filing your taxes.

My income from this was less than 100. The 1099-NEC short for Non-Employee Compensation is used to report direct payment of 600 or more from a company for your services. This form is known as a 1099 and it comes in a number of varietiesTheres.

If youre having issues accessing your 1099 or havent received it on time report your tax issue to Postmates. Depending on how much you earn in a year you may or may not qualify to receive a Form 1099-MISC for your taxes. If you make less than 600 a year you wont receive a 1099 from them but you will still have to report the gross amount to the IRS.

I have yet to get my 1099 from Postmates for doing deliveries for them last year. If you earn more than 600 in a year as an independent contractor to a third party the company contracting your services. The company doesnt compile an annual tax summary for you rather it recommends you refer back to your emailed weekly tax reports.

You are starting to get your 1099 forms from Grubhub Doordash Postmates and Uber Eats. Its the end of January. I did postmates primarily in 2015 but only tried it a couple times in 2016.

This is not meant to be a talk about taxes. Its tax time isnt it. If youve met the 600 annual income threshold Postmates should send you a 1099-MISC either online electronically or both.

The most important box on this form that youll need to use is Box 7 Non-employee Compensation. Need help contacting Postmates for my 1099 to file my taxes. Go to Tax Information and click Send my 1099 form electronically When you have chosen to receive your tax forms electronically you will be able to view and download your 1099 forms directly in the app as soon as they get filed.

Postmates Grubhub and Doordash along with most other gig platforms use the 1099-Misc form. Now that I am thinking about it did move and they might not have my new address. Here is the link youll need to request a 1099 from Postmates.

While Stride operates separately from Postmates I can tell you that Postmates will only prepare a 1099-MISC. How do I get access to my Form 1099-MISC from Postmates. The IRS requires them to send out their 1099s by January 31st.

Instead we recommend you get your 1099 form in the app. If you earned less than 600 on the Postmates platform during the year you wont receive a 1099-MISC. Uber Eats uses a 1099-MISC as well as 1099-K.

Open the menu and go to Personal Info. This reports your total earnings from Postmates for last year. Postmates only sends 1099 forms to Postmates who make 600 or more in the past year.

From Form 1099-MISC. Heres how its broken down. My tax software would ask me to enter the amount from each of my 1099 forms and it would add it up for me.

How To Get Your 1099 Form From Postmates

How To Get Your 1099 Form From Postmates

Didn T Receive A Form 1099 Don T Ask

Didn T Receive A Form 1099 Don T Ask

Didn T Get Your 1099 For 2017 Here S What To Do Youtube

Didn T Get Your 1099 For 2017 Here S What To Do Youtube

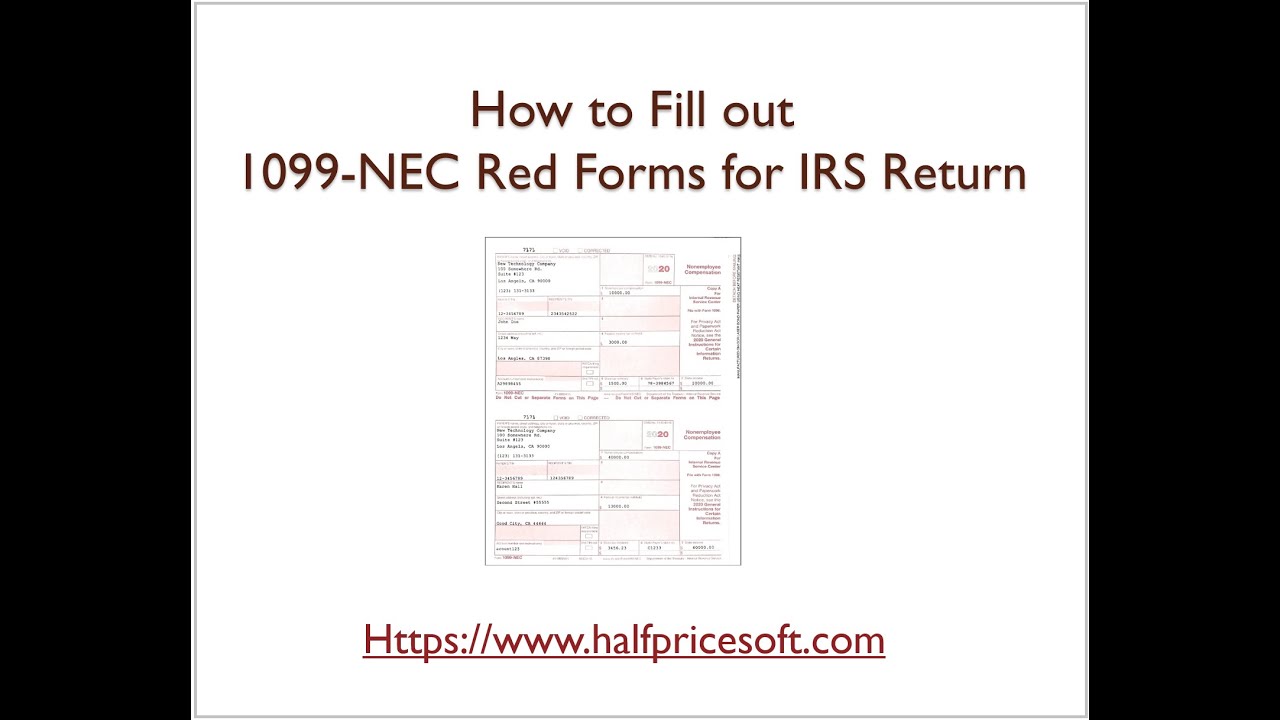

How To Fill Out 1099 Nec Red Forms For Irs Return Youtube

How To Fill Out 1099 Nec Red Forms For Irs Return Youtube

Finding And Filing Your Shopify 1099 K Made Easy

Finding And Filing Your Shopify 1099 K Made Easy

Pin By Neona Burton On Shmoney Doordash Instacart Tax

Pin By Neona Burton On Shmoney Doordash Instacart Tax

1099 Says I Made More Than Double What I Actually Did Anyone Else Have This Problem Postmates

1099 Says I Made More Than Double What I Actually Did Anyone Else Have This Problem Postmates

How To Get Your 1099 Form From Postmates

How To Get Your 1099 Form From Postmates

Form 1099 Nec Instructions And Tax Reporting Guide

Form 1099 Nec Instructions And Tax Reporting Guide

Can I Print 1099 On Plain Paper And Other Tax Form Questions Blue Summit Supplies

Can I Print 1099 On Plain Paper And Other Tax Form Questions Blue Summit Supplies

How To Get Your 1099 Form From Postmates

How To Get Your 1099 Form From Postmates

1099 Nec Schedule C Won T Fill In Turbotax

1099 Nec Schedule C Won T Fill In Turbotax

Hey My Irs Form 1099 Is Wrong Maybe Intentionally

Hey My Irs Form 1099 Is Wrong Maybe Intentionally

Massachusetts Joins Fight In Classifying Drivers As Employees Rideshare Driver Rideshare Lyft Driver

Massachusetts Joins Fight In Classifying Drivers As Employees Rideshare Driver Rideshare Lyft Driver

What Is A 1099 Form A Simple Breakdown Of The Irs Tax Form

What Is A 1099 Form A Simple Breakdown Of The Irs Tax Form

Form 1099 Nec Instructions And Tax Reporting Guide

Form 1099 Nec Instructions And Tax Reporting Guide

If Rideshare Driving Is So Bad Why Do People Keep Doing It Why Do People Rideshare Uber Driving

If Rideshare Driving Is So Bad Why Do People Keep Doing It Why Do People Rideshare Uber Driving