Does A 1099 Contractor Need A Business License In Georgia

Before registering for any tax type learn more about the differences and requirements for each of the tax types by visiting Tax Registration. You dont necessarily have to have a business for payments for your services to be reported on Form 1099-NEC.

Incorporate In Georgia Do Business The Right Way

It is important to know that most California cities and counties have a business license tax ordinance.

Does a 1099 contractor need a business license in georgia. First Steps to Becoming an Independent Contractor. There are significant differences in the legalities of a contractor and employee. Rules for business registration vary depending on location and what the business does.

Check with the citys or countys Business License Bureau. I am paid on a 1099 basis not as a W2 employee. Entities doing business in Georgia may need to register for one or more tax types in order to obtain the specific identification numbers permits andor licenses required.

A 1099 contractor is a person who works independently rather than for an employer. If you decided to put your name on a sign outside your office soliciting business then you will need to sign up for a business license register for a trade name with the towncity you are in. There is no general state of Georgia business license however many cities require businesses to apply for an occupational tax certificate in order to operate.

An independent contractor must be classified as exempt with a 1099 form where the independent contractor pays their own income tax and self-employment. What is the state agency. If you want to pay via 1099 the subcontractors must be truly independent from you - meaning they must be fully licensed not under your license maintain their own books pay their own taxes etc.

You will need a separate Business License to conduct business in any other city or county. A few states -- including Alaska and Washington -- require all businesses to get a state business license. However because of the complexity in Georgia law even where a 1099 is present you still might be considered an employee and therefore entitled to workers compensation benefits.

The cost of a business license will depend too on the gross receipts of the business in some cities. First understand that there are a lot of things you DONT NEED to do when starting a business. Get a tax registration certificate and a vocational license if required for your profession.

Out of State Business Application. Choose a business name and register it if necessary. If you have done withholding for any contractors youll need to file a G-1003 Form.

By the way although it wont cover you for being caught operating without a license protecting your livelihood with General Liability insurance is a must for independent contractors. Yes if you are not paid as an employee you are considered an independent contractor and are. No you do not need a business license.

If you are self-employed you can start with Form 1040-ES Estimated Tax for Individuals and then file the other necessary forms with your 1040 Form during the tax season. Most states arent this fussy but they do require people in certain occupations -- such as doctors lawyers nurses and architects -- to get a state license. Yes the state does.

The answer depends on where you work and what you do. While the work can be similar in nature it is important to follow the law with regard to taxes payments and the like. Do I need a business license.

Make sure you really qualify as an independent contractor. If you need help with a 1099 contractor needing a business license you can post your job on UpCounsels marketplace. What you need to know Whether a worker is an employee or an independent contractor is critical when it comes to such important issues as pension eligibility workers compensation coverage wage and hour law and many other matters.

Answer If payment for services you provided is listed on Form 1099-NEC Nonemployee Compensation the payer is treating you as a self-employed worker also referred to as an independent contractor. Learn more about combined state and federal filing. COVID-19 vaccine eligibility in Georgia is open for everyone 16 years of age and older.

If you are moving to a commercial location you must fill out a new commercial business license application. Whether it is in construction or any other area of work independent contractor rules are very specific in Washington. At a minimum do these four things when youre first starting out as an independent contractor.

In most cases if you participated in combined filing for your 1099s then you do not need to additionally send them to the state State Revenue Commissioner they should already have a copy. Now that we have that out of the way lets talk about starting your independent contractor business. This application is for out of state contractors who are doing business within Forsyth County.

However do be aware that the consequences of being found in operation without a business license for independent contractors can be rather costly.

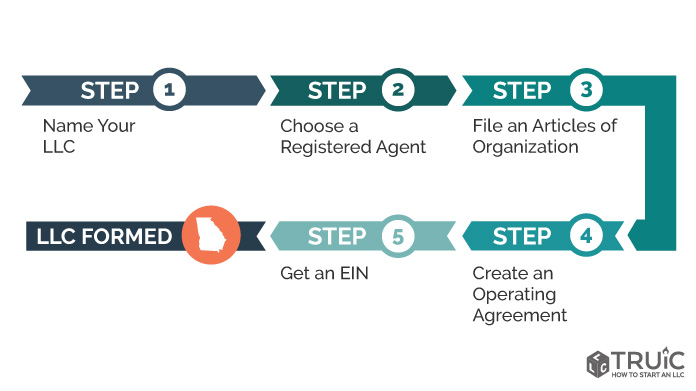

![]() Llc Georgia How To Form An Llc In Georgia

Llc Georgia How To Form An Llc In Georgia

Hiring Your First Employee Business Advisor Hiring Employees Independent Contractor

Hiring Your First Employee Business Advisor Hiring Employees Independent Contractor

Certified Contractors Licensed Approved Atlanta Georgia Exovations

Certified Contractors Licensed Approved Atlanta Georgia Exovations

Sample Freelance Writing Contract Freelance Contract Freelance Writing Contract Template

Sample Freelance Writing Contract Freelance Contract Freelance Writing Contract Template

Pin On Resume Samples Ideas Printable

Pin On Resume Samples Ideas Printable

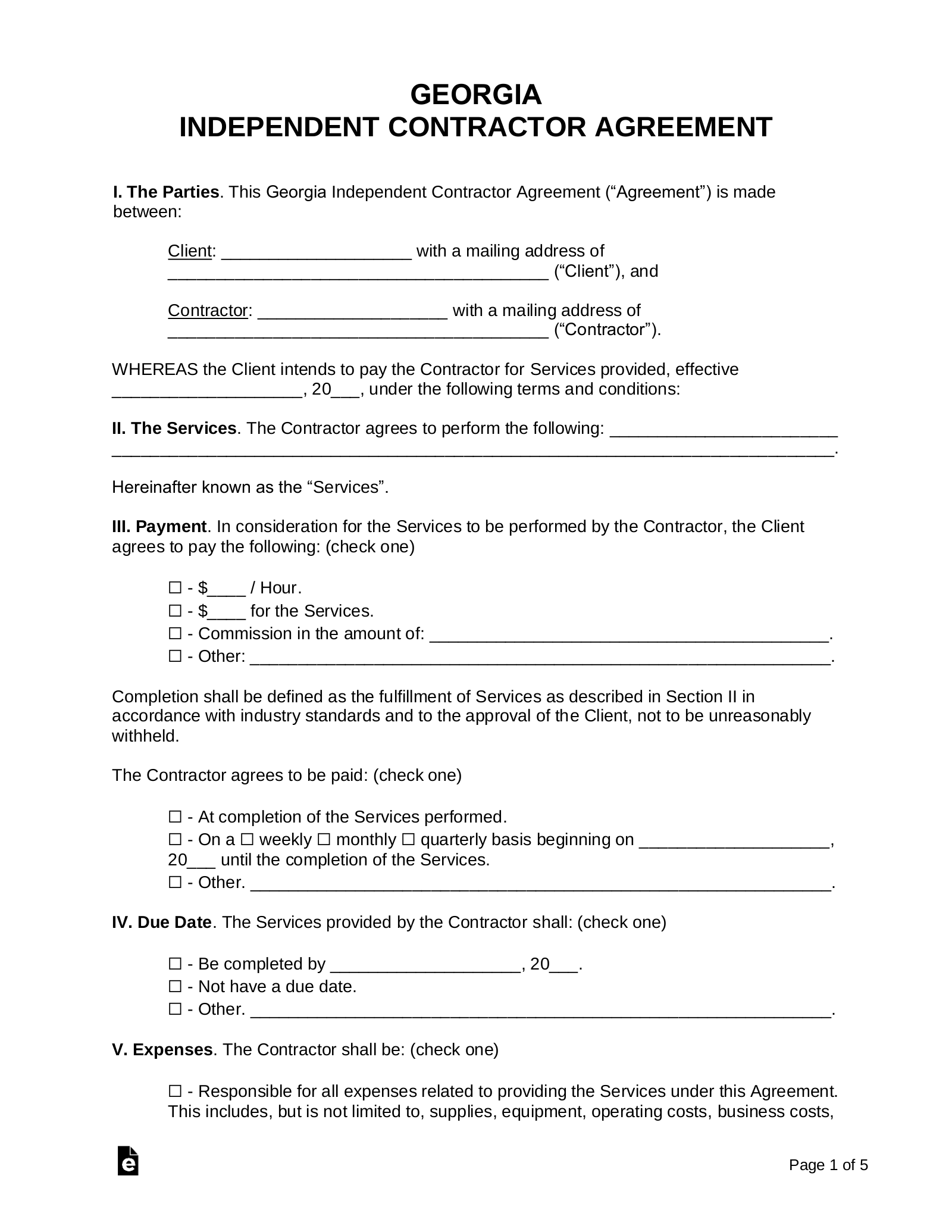

Free Georgia Independent Contractor Agreement Word Pdf Eforms

Free Georgia Independent Contractor Agreement Word Pdf Eforms

Free Georgia Quitclaim Deed Form How To Write Guide

Free Georgia Quitclaim Deed Form How To Write Guide

Free Power Of Attorney Georgia Forms Durable Medical Limited Financial

Free Power Of Attorney Georgia Forms Durable Medical Limited Financial

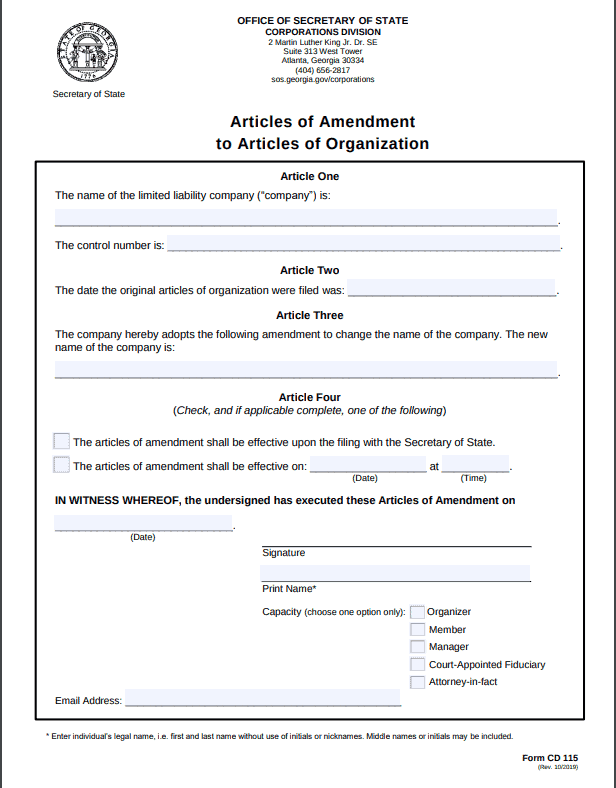

How To File A Georgia Llc Amendment With The Secretary Of State

How To File A Georgia Llc Amendment With The Secretary Of State

Https Www Dekalbcountyga Gov Sites Default Files Users User3566 Complete 20homebased 20new 20application 20package 20v 2 Pdf

Llc Georgia How To Form An Llc In Georgia

Llc Georgia How To Form An Llc In Georgia

Subcontractor Contract Template Free Elegant Need A Subcontractor Agreement 39 Free Templates Here Contract Template Template Free Templates

Subcontractor Contract Template Free Elegant Need A Subcontractor Agreement 39 Free Templates Here Contract Template Template Free Templates

Llc Georgia How To Form An Llc In Georgia

Llc Georgia How To Form An Llc In Georgia

Free Georgia Bill Of Sale Form Pdf Template Legaltemplates

Free Georgia Bill Of Sale Form Pdf Template Legaltemplates

Pros And Cons Of Running A Georgia Llc Legalzoom Com

Pros And Cons Of Running A Georgia Llc Legalzoom Com

Fence Line Agreement Contract Template Legal Forms Business Plan Template

Fence Line Agreement Contract Template Legal Forms Business Plan Template

Florida Contractor S License Requirements Exceptions And Penalties

Florida Contractor S License Requirements Exceptions And Penalties

Oregon State Business Registry In 2020 Business Assistance Business Oregon State

Oregon State Business Registry In 2020 Business Assistance Business Oregon State

Operating Agreement Template For Corporation Gallery

Operating Agreement Template For Corporation Gallery