What Legal Form Of Business Organization Is Most Common

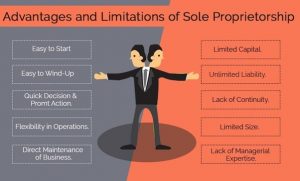

SOLE PROPRIETORHIP Sole proprietorship is a business owned and operated by an individual for his or her own profit. The three most common legal forms of business organization are the sole proprietorship partnership and corporation.

Ferguson Business Associations Flowcharts Spring 2009 Law School Survival Law Notes Law School Life

Ferguson Business Associations Flowcharts Spring 2009 Law School Survival Law Notes Law School Life

Sole proprietorship is the most common form of business.

What legal form of business organization is most common. But the business owner is also personally liable for all financial obligations and debts of the business. Three Basic Forms of Business Organization Sole Proprietorships. A sole proprietorship is the most common form of business organization.

Which form of business organization is larger in terms of total sales total assets earnings and number of employees. Sole Proprietorship Click card to see definition Unincorporated business owned and run by a single person who has rights to all profits and unlimited liability for all debts of the firm. Which form of business organization is larger in terms of total sales total assets earnings and number of employees.

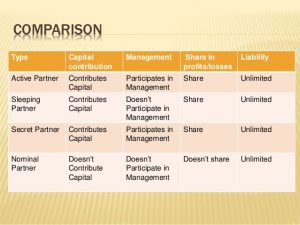

The three most common legal forms of business organization are the sole proprietorship partnership and corporation. It is considered as the most common form of business ownership. An unincorporated business owned by two or more persons voluntarily acting as.

Its easy to form and offers complete control to the owner. Click again to see term. View Answer Which legal form of business organization is most common.

An unincorporated business owned by one person is called a sole proprietorship. SOLE PROPRIETORHIP Sole proprietorship is a business owned and operated by an individual for his or her own profit. It is considered as the most common form of business ownership.

Which form of business organization is most common. Most common form of business organization in the United States. The most common legal forms of organization used by small businesses are the sole proprietorship the partnership the corporation.

As a sole proprietor you can operate any kind of. In a sole proprietorship the owner receives all profits bears all losses. The principal disadvantage of this form is the owners unlimited liability.

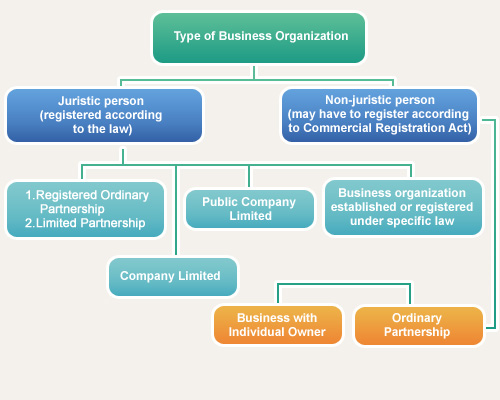

Types Of Business Organizations What Business Organization Should You Establish Your Business Under Business Organization Business Infographic Infographic

Types Of Business Organizations What Business Organization Should You Establish Your Business Under Business Organization Business Infographic Infographic

Advantages And Disadvantages Of Business Organization Type The Lawyers Jurists

Advantages And Disadvantages Of Business Organization Type The Lawyers Jurists

Ellie Photography Business Structure Business Ownership Business

Ellie Photography Business Structure Business Ownership Business

Advantages And Disadvantages Of Business Organization Type The Lawyers Jurists

Advantages And Disadvantages Of Business Organization Type The Lawyers Jurists

Professional Corporation Is It The Best Business Structure Business Law Business Structure Business

Professional Corporation Is It The Best Business Structure Business Law Business Structure Business

One Of The Most Common Questions I Get From Entrepreneurs Is How They Should Initially Set Up Their Bu Business Tax Deductions Sole Proprietorship Llc Business

One Of The Most Common Questions I Get From Entrepreneurs Is How They Should Initially Set Up Their Bu Business Tax Deductions Sole Proprietorship Llc Business

Durable Power Of Attorney Agreement Power Of Attorney Attorneys Power

Durable Power Of Attorney Agreement Power Of Attorney Attorneys Power

How To Choose The Best Legal Structure For Your Business Pros Cons Business Structure Small Business Management Business Venture

How To Choose The Best Legal Structure For Your Business Pros Cons Business Structure Small Business Management Business Venture

How To Start An Llc In Nevada Llc Business Annual Report Estate Planning Attorney

How To Start An Llc In Nevada Llc Business Annual Report Estate Planning Attorney

Advantages And Disadvantages Of Business Organization Type The Lawyers Jurists

Advantages And Disadvantages Of Business Organization Type The Lawyers Jurists

The Seven Most Popular Types Of Businesses Legal Business Business Ownership Profit And Loss Statement

The Seven Most Popular Types Of Businesses Legal Business Business Ownership Profit And Loss Statement

Corporations Big Picture Bar Exam Study Materials Law School Life Studying Law Law School Prep

Corporations Big Picture Bar Exam Study Materials Law School Life Studying Law Law School Prep

Comparison Chart Of Business Entities Startingyourbusiness Com Sole Proprietorship Business Comparison

Comparison Chart Of Business Entities Startingyourbusiness Com Sole Proprietorship Business Comparison

The Seven Most Popular Types Of Businesses Volusion

The Seven Most Popular Types Of Businesses Volusion

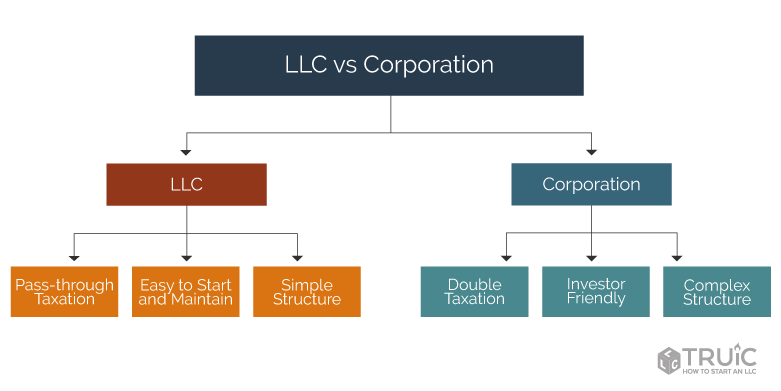

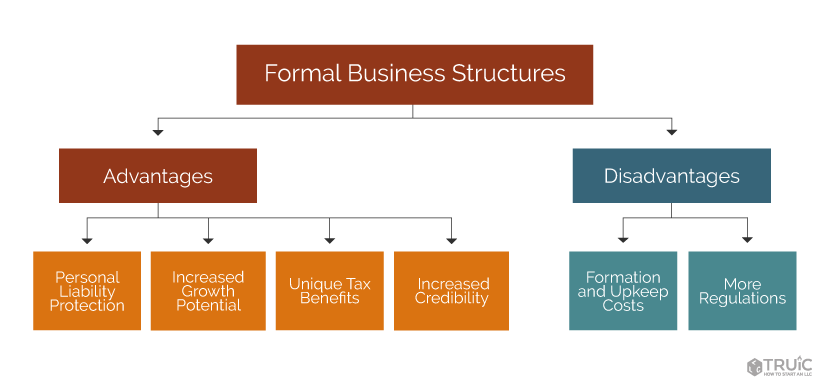

Business Structure How To Choose A Business Structure Truic

Business Structure How To Choose A Business Structure Truic

4 Most Common Business Legal Structures Pathway Lending

4 Most Common Business Legal Structures Pathway Lending

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

A Sole Proprietorship Is The Simplest And Least Expensive Business Structure To Establish Costs Are Minimal W Sole Proprietorship Business Structure Business

Business Structure How To Choose A Business Structure Truic

Business Structure How To Choose A Business Structure Truic

Business Landscape 1000 American Business Landscaping Business Cards Business Structure

Business Landscape 1000 American Business Landscaping Business Cards Business Structure