How To Change Loan Tenure Hdfc

HDFC Home Loan Calculator helps you calculate Home loan EMI and payable interest. Mar 28 2020 How Can You Approach HDFC for a Change in Your Housing Loan Tenure.

Should I Take A Housing Loan From Hdfc Or Sbi Quora

Increasing your EMI amount by 5 every year is definitely a smart choice to reduce your interest repayment burden.

How to change loan tenure hdfc. About fixed rate home loan and its benefits. Use our Free HDFC EMI calculator to calculate the total payable amount at customized interest rate. HDFC Home Loans are easy to apply with simple documentation and transparent process.

Dec 18 2018 Since the process differs from bank to bank it is not possible to list a standard procedure here. The concerned official will go through your loan statement and latest income statements before allowing you to change the tenure. While applying you can decide to top up the balance on your home loan reduce EMI or reduce tenure.

The bank will now evaluate your application and decide your eligibility. You can choose from different EMI repayment options that suit your pocket flexible tenures completely online. They will ask you to fill out a form and pay a small processing fees to do the same.

One of the leading providers of Personal Loans in India HDFC Bank offers the best loan option that comes with a unique array of features and benefits. This is an effective trick to reduce your loan tenure and in turn the interest cost. You can visit the branch of HDFC Limited or HDFC Bank with the latest loan statement indicating the principal and interest repayment made so far the outstanding balance left to service etc.

In a fixed rate loan the interest rate is fixed at the time of taking the home loanApart from a regular fixed rate product where the rate of interest is constant over the entire term of the loan there are variants available which allow you to fix your interest rate for specific periods of 2 3 or 10 years and is available with the right of reset. NEFT Available 24 7 UPI Instant Mobile Money Transfer. Simple way to foreclose your entire business loan any time after paying 12 EMIs charges up from 2 to 4.

You can align this increase with your increase in salary or receiving any other annual bonus. No collateral or guarantor required for the loan approval Easily transfer the balance Flexible tenure and easy processing of loan amount. Apr 06 2021 The high amount of loan up to Rs.

You may be required to sign another NACH form since the EMI amount will change. With our customised solutions we have fulfilled over 54 million dreams since its inception. HDFC offers home loans with EMIs starting from 646 per lac and interest rates starting from 670 pa.

You can visit the branch of the lender and give a request for the same. HDFC offers you an option to convert your existing adjustable rate to HDFCs current adjustable rate by effectuating a change in the spread as indicated in the loan agreement. Once the process is complete you will need to ask them for an amortization schedule for the revised home loan EMI and tenure.

Interest Rates pa For any loan amount 670 to 720. Here is why HDFC is a household name that Indians proudly reckon with. With a low-interest rate and long repayment tenure HDFC ensures a comfortable home loan EMI for you.

All that you would need to do is visit their branch and put up a request. With additional features such as flexible repayment options and top-up loan. The tenure of the loan is also dependent on the customers profile age of customer at maturity of loan age of property at loan maturity depending upon the specific repayment scheme as may be opted and any other terms which may be applicable based on prevalent norms of HDFC.

You can definitely change the tenure of your loan with HDFC or any other housing finance company. HDFC Bank business loan eligibility calculator. The fee payable shall be 025 plus applicable taxes of the principal outstanding plus the undisbursed loan amount or 15000 plus applicable taxes whichever is lower.

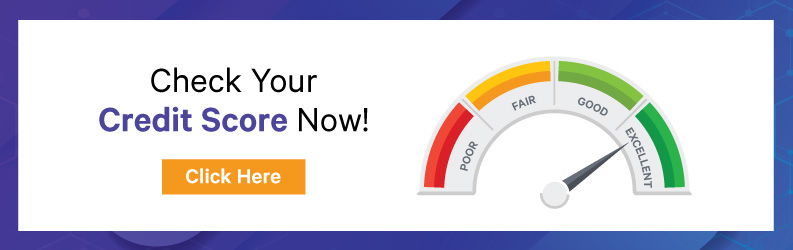

With the HDFC Bank Loan Restructuring Scheme customers can choose to extend their balance tenure to a further period of 24 months that will make their EMIs affordable. Retail Prime Lending Rate. Process of Changing the Home Loan Tenure The tenure can be changed voluntarily anytime during the course of the loan.

Dec 28 2018 Its a simple process you will need to contact your bank and tell them that you need to reset your home loan tenure. Keeping in line with the central bank HDFC Bank Loan Restructuring Scheme is available to borrowers with which they can extend their tenure by a maximum of 24 months. HDFC is a leading provider of Housing Finance in India.

Special Home Loan Rates. PAY Cards Bill Pay.

Study Of The Procedure Of Disbursement Of Home Loan Of Hdfc Bank In P

Study Of The Procedure Of Disbursement Of Home Loan Of Hdfc Bank In P

Personal Loan Everything You Need To Know About Personal Loan Hdfc Bank

Personal Loan Everything You Need To Know About Personal Loan Hdfc Bank

Hdfc Personal Loan Status Online Track Loan Application Status Online

Hdfc Personal Loan Status Online Track Loan Application Status Online

Personal Loan On Speed The Pre Approved Personal Loan

Personal Loan On Speed The Pre Approved Personal Loan

Hdfc Bank Personal Loan Covid 19 Moratorium Emi Period How To Apply Status

Hdfc Bank Personal Loan Covid 19 Moratorium Emi Period How To Apply Status

Hdfc Bank Insta Jumbo Loan Our Review Emi Calculator

Hdfc Bank Insta Jumbo Loan Our Review Emi Calculator

Hdfc Bank Personal Loan Rate Of Interest 10 50 Iservefinancial

Hdfc Bank Personal Loan Rate Of Interest 10 50 Iservefinancial

How To Get An Hdfc Car Loan Statement Quora

Hdfc Bank Loans Expert Guide Eligibility Interest Rates

Hdfc Bank Loans Expert Guide Eligibility Interest Rates

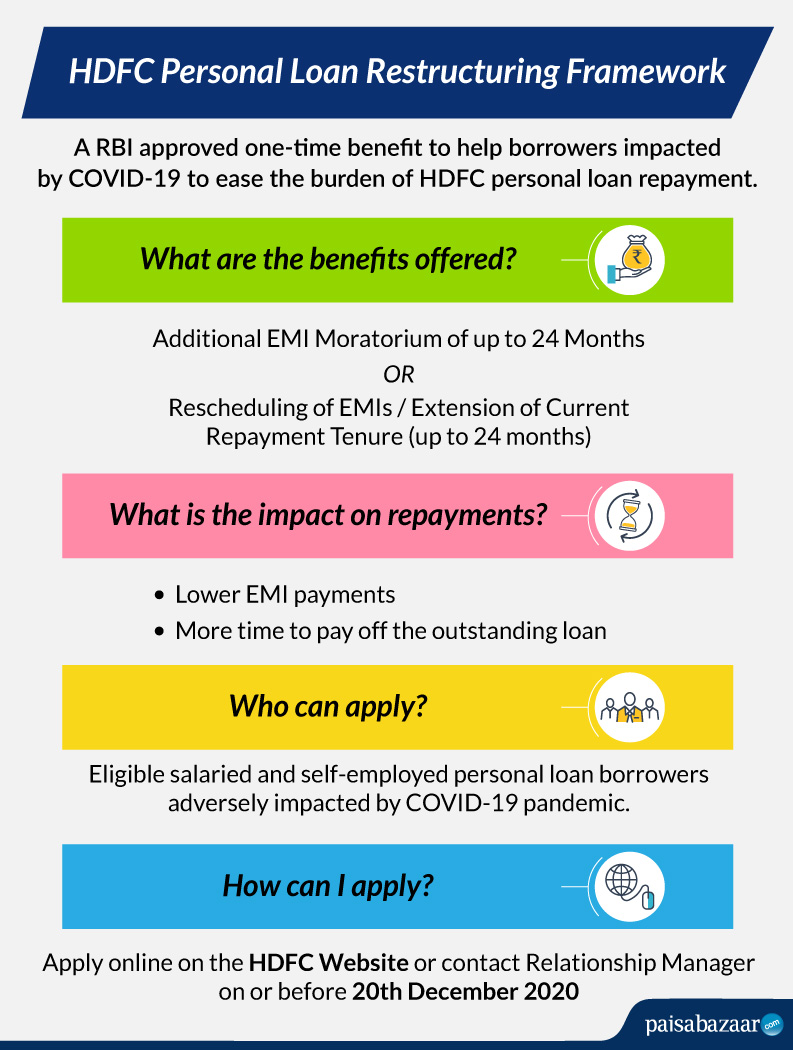

Hdfc Personal Loan Restructuring Covid 19 Paisabazaar Com

Hdfc Personal Loan Restructuring Covid 19 Paisabazaar Com

Hdfc Bank Personal Loan Eligibility Emi S Interest Rates By Bookmypersonalloan Medium

Hdfc Bank Personal Loan Eligibility Emi S Interest Rates By Bookmypersonalloan Medium

Plot Loans For Nris In Other Location Nri Plot Loans In Other Location Hdfc Ltd

Plot Loans For Nris In Other Location Nri Plot Loans In Other Location Hdfc Ltd

Hdfc Nri Home Loan 2021 22 Latest Rates And Benefits Sbnri

Hdfc Nri Home Loan 2021 22 Latest Rates And Benefits Sbnri

What Is The Processing Time For An Hdfc Personal Loan Quora

Hdfc Home Loan Status How To Check Home Loan Application Status

Hdfc Home Loan Status How To Check Home Loan Application Status

Ways To Increase Your Hdfc Personal Loan Tenure By Mymoneymantra Medium

Ways To Increase Your Hdfc Personal Loan Tenure By Mymoneymantra Medium

Good News 3 Month Emi Moratorium On Hdfc Bank Loans And Credit Card Bills Youtube

Good News 3 Month Emi Moratorium On Hdfc Bank Loans And Credit Card Bills Youtube