Florida Small Business License Application

For example many businesses are responsible for sales and use tax unemployment tax and corporate income tax. Getting Started with a Florida Business.

Starting Wednesday February 24 2021 and running through Tuesday March 9 2021 the exclusive small-employer PPP processing window is designed to provide more equitable relief by targeting the PPP to the smallest businesses and those that have been left behind in previous relief efforts to ensure that lenders give smaller employers the attention they need to work their way through the application.

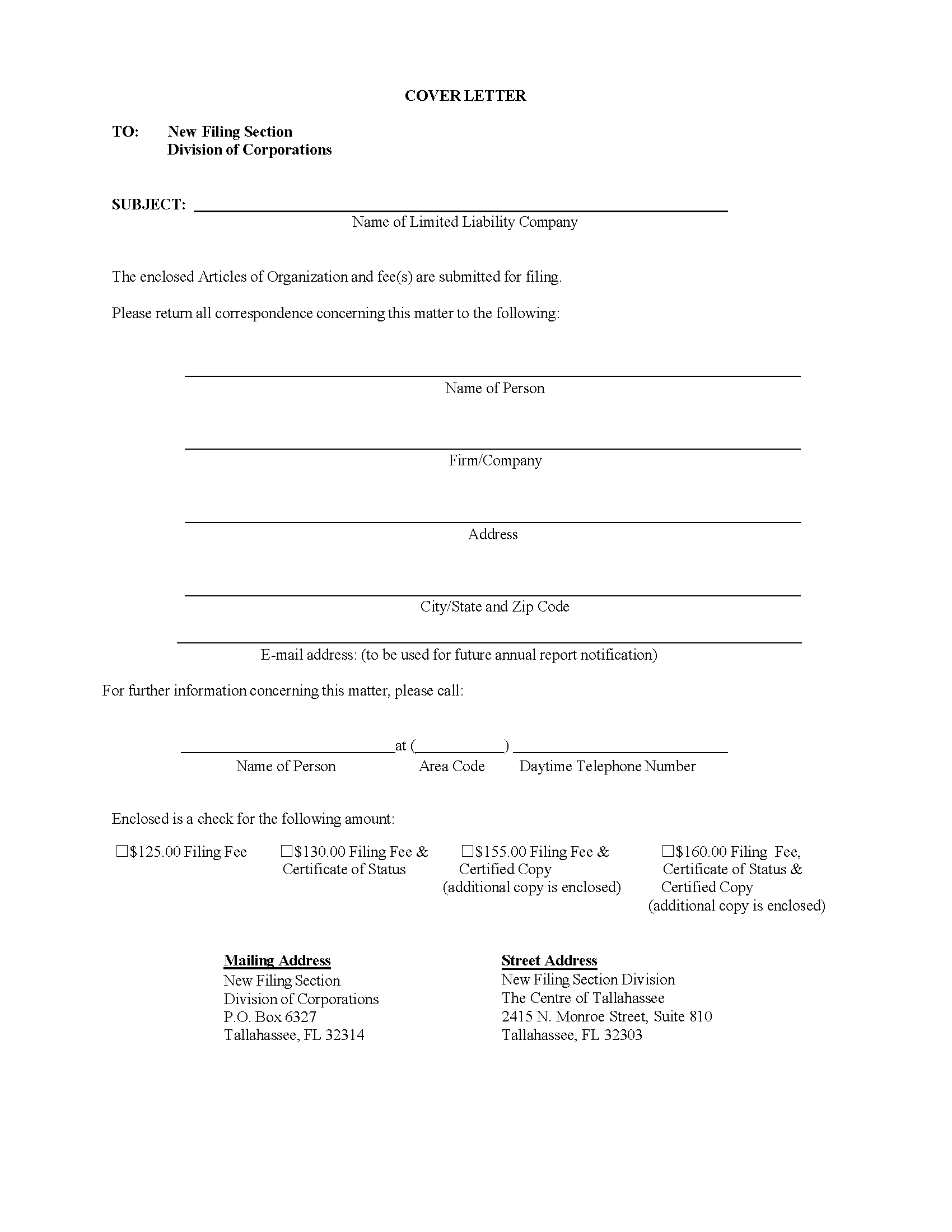

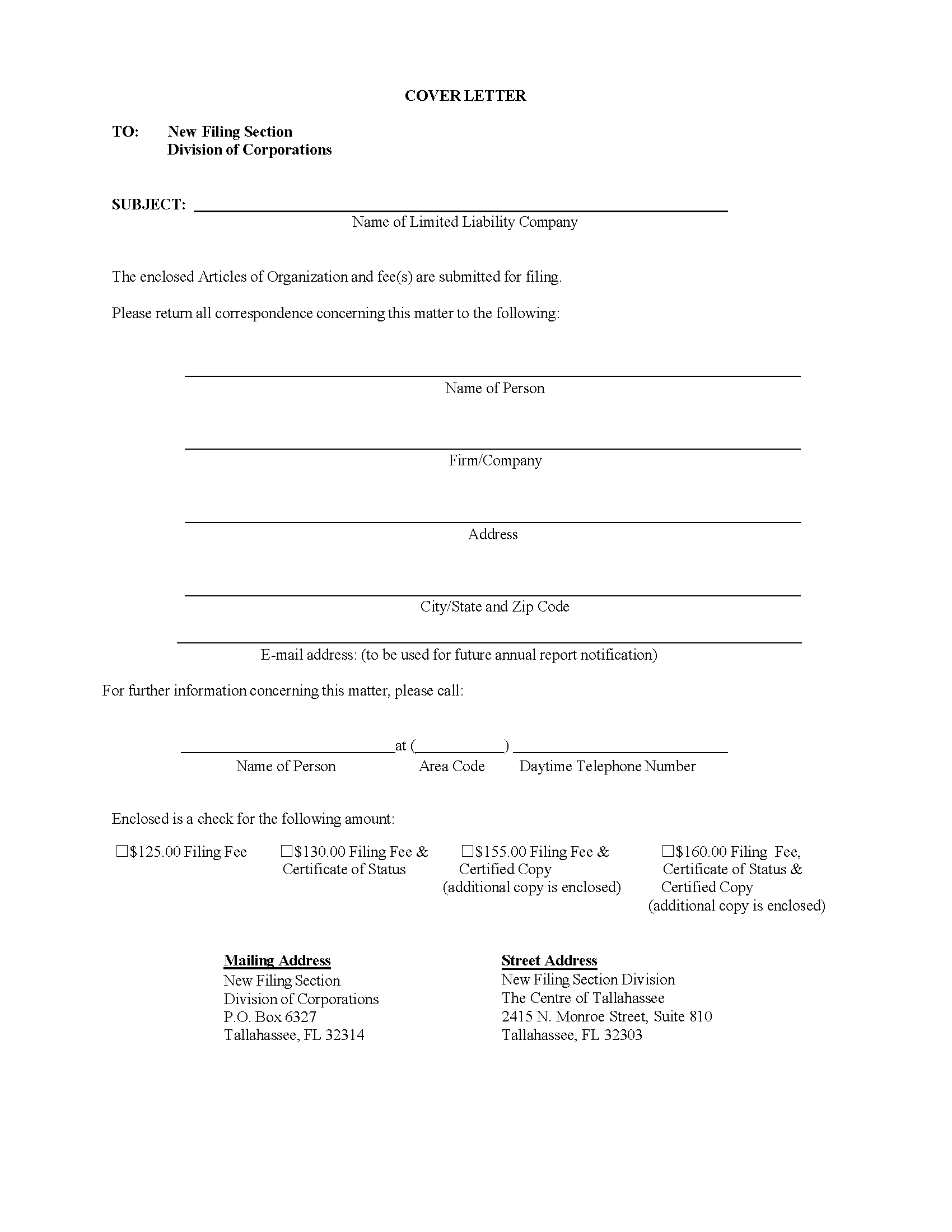

Florida small business license application. You are required to complete the correct application see Forms pay fees and in most cases have inspections in order to comply and be issued a local business tax receipt formerly known as occupational license. By Florida law it is the responsibility of the business owner to pay their local business tax whether a notice is received or not. Fictitious Name Registration Filing.

Identify Your Type of Business. Profit Articles of Incorporation Non-Profit Articles of Incorporation. You can also check there to determine if your business has additional state licensing requirements.

By mail complete the Business License Application along with any additional forms and payment to the address on the form. Business Occupational LicenseLocal Business Tax Receipt Sample Tax Receipt 82937 KB. Johns County Chamber of Commerce and other resource partners coordinate efforts to support your small business.

Licensing licensed and regulated by the Florida Department of Business and Professional Regulation. The issuance of local business tax receipts does not eliminate any city or state requirement as it relates to the regulation of businesses or professions. Starting a Business in Florida.

2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607. Apply for licenses and permits Most small businesses need a combination of licenses and permits from both federal and state agencies. There are additional fees for each.

Many industries may require a license from the State of Florida. Mailed applications can take up to six weeks to process. Concealed weapons permits are issued by the State of Florida and not the Volusia County Sheriffs Office.

The application fee for a Business License Application varies. As a service to citizens applications are available free from the Sheriffs Office. We will then submit your Florida business license applications online wherever possible or send you forms that are.

1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. Get a Business License. Start a Business Step 1.

SBA Small Business Planner JAX Chamber Small Business Center University of North Florida Small Business Development Center. See instructions on how to determine your processing fee. A legal representative and accountant should be consulted before making a determination as to the type of business entity to form.

You may need to contact the IRS to be issued a FEIN federal employers ID number. A business licenseoccupational license or business tax receipt is required by most counties in Florida to have the legal ability to do have a business in that county. The Countys Economic Development Office St.

Check with your local tax collectors office to see what they require. Small Business Resources Thank you for your interest in starting a new business in St. Decide on a Corporate Structure.

Business tax is regulated by Florida Statute Chapter 205 as well as City of West Palm Beach Ordinance Chapter 82. The requirements and fees vary based on your business activities location and government rules. Research Starting a Business.

Department of Business Professional Regulation DBPR DBPR licenses everything from architects. Rules for business registration vary depending on location and what the business does. Registration with the Florida Division of Corporations and license applications with the Florida Department of Business and Professional Regulation may be done online through those agencys websites.

Small businesses in the state of Florida must register for identification numbers permits or licenses for the taxes that correspond with their specific services. At the time of applying the County Tax Collector will determine the type of business tax receipt you will be issued and then calculate your business. Or Attestation of No License Required Transfer of Ownership.

For some professions you can apply and update your licenses online at the Florida Department of Business and Professional Regulation. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business. To show proof of required licensing submit ONE of the following.

The application procedures for local business tax receipts depend on the city andor county where your business is located. 3 Oversee property tax administration involving 109. 1 Florida Tax Registration.

Business License There is no general state of Florida business license however many cities require businesses to be licensed in order to operate. To obtain a burn permit call the Florida Forest Service at 386-585-6151. The information below focuses mostly on the skilled trades with some resources for other professions.

LICENSES PERMITS REGISTRATION. A Business Licenses LLC expert will talk with you and complete the Florida business license applications on your behalf regardless of complexity. For transfer of ownership the following documents shall be.

Choosing a Business Ownership Structure. Be sure you have a valid picture ID a fictitious name certificate if applicable your social security number and if you are engaging in any professional services your state license. The last step would be a bank account for the new company.

Form a Profit or Non-Profit Corporation.

Browse Our Sample Of Single Member Llc Operating Agreement Template Limited Liability Company Liability Agreement

Browse Our Sample Of Single Member Llc Operating Agreement Template Limited Liability Company Liability Agreement

How To Have A Fantastic Business License Lookup With Minimal Spending Business License Lookup Https Businessneat Com How To Business Online Business Names

How To Have A Fantastic Business License Lookup With Minimal Spending Business License Lookup Https Businessneat Com How To Business Online Business Names

Free Online Receipt Maker Fake Business License Fake Receipt Us Receipt Maker Receipt Letter Of Employment

Free Online Receipt Maker Fake Business License Fake Receipt Us Receipt Maker Receipt Letter Of Employment

Utility Bill Fpl Psd Electric Power Utility Florida Power Light Company Fpl Utility Bill Bill Template Statement Template

Utility Bill Fpl Psd Electric Power Utility Florida Power Light Company Fpl Utility Bill Bill Template Statement Template

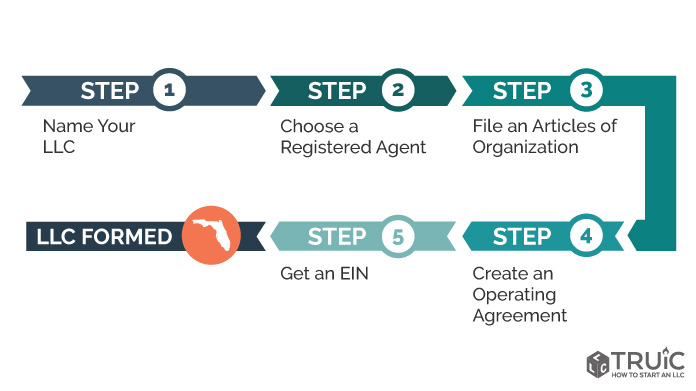

How To Form An Llc In Florida Startingyourbusiness Com

How To Form An Llc In Florida Startingyourbusiness Com

Forming Business In Broward What You Ll Need To Do Llc Or Fictitious Name Sunbiz Org Ein If You Ll Be Selling Tangible Go Business Tax Irs Gov Broward

Forming Business In Broward What You Ll Need To Do Llc Or Fictitious Name Sunbiz Org Ein If You Ll Be Selling Tangible Go Business Tax Irs Gov Broward

You Can See This Valid Request For License Letter Format At Valid Request For License Letter Format Business Letter Example Consent Letter Format Letter Sample

You Can See This Valid Request For License Letter Format At Valid Request For License Letter Format Business Letter Example Consent Letter Format Letter Sample

Doing Business In The State Of Florida Florida Businesses

Doing Business In The State Of Florida Florida Businesses

Fake Business License Template Birth Certificate Template Certificate Templates Marriage Certificate

Fake Business License Template Birth Certificate Template Certificate Templates Marriage Certificate

Florida Business License What You Need To Know Hyke How To Get Clients Business Tax Business

Florida Business License What You Need To Know Hyke How To Get Clients Business Tax Business

Home Business Ideas For Disabled One Existing Business Investing Finance Investing Investing Money Management Advice

Home Business Ideas For Disabled One Existing Business Investing Finance Investing Investing Money Management Advice

Applying For A Small Business Loan Small Business Loans Business Loans Small Business

Applying For A Small Business Loan Small Business Loans Business Loans Small Business

Llc Florida How To Start An Llc In Florida

Llc Florida How To Start An Llc In Florida

Starting A Business Offering Cleaning Services In Florida Is Not A Complex Process And Requires No Sp Cleaning Business Business Employer Identification Number

Starting A Business Offering Cleaning Services In Florida Is Not A Complex Process And Requires No Sp Cleaning Business Business Employer Identification Number

Llc Florida How To Start An Llc In Florida

Llc Florida How To Start An Llc In Florida

8 Different Licensing Services That You Might Need As A Florida General Contractor Contractors General Contractor Service

8 Different Licensing Services That You Might Need As A Florida General Contractor Contractors General Contractor Service

State Of Florida Com Incorporate In Florida

State Of Florida Com Incorporate In Florida