Am I Self Employed If I Get A 1099 Misc

The short answer is. The 600 rule often gives payees the wrong impression that they dont have to report their own 1099 earnings if they make less than 600.

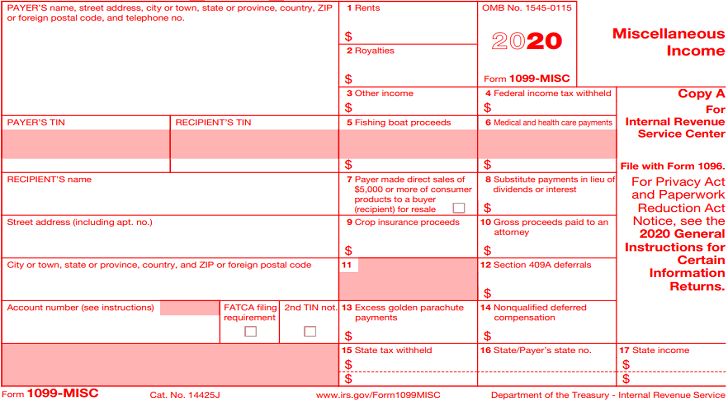

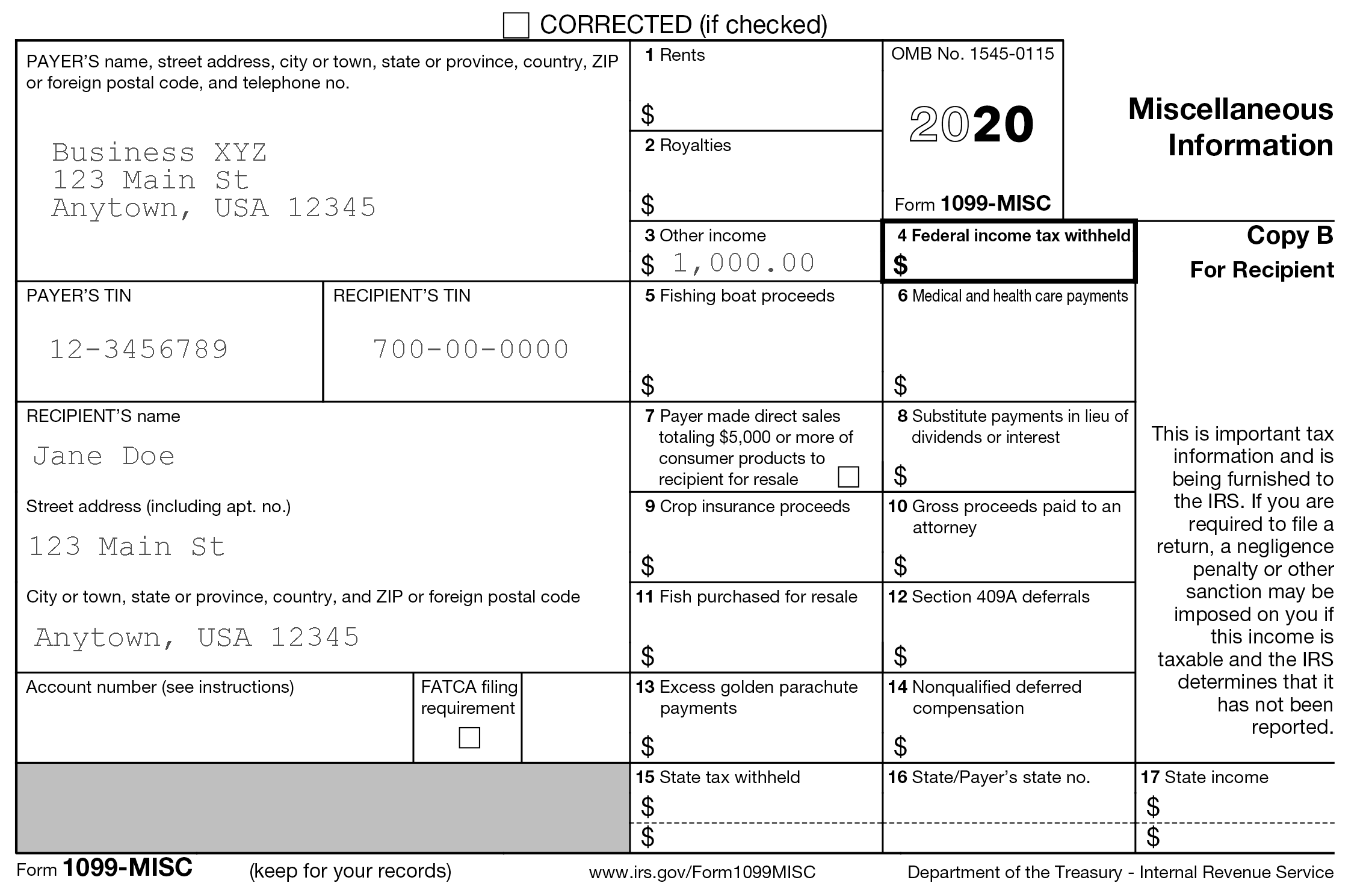

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Most individuals who receive 1099s are self-employed independent contractors.

Am i self employed if i get a 1099 misc. If your Form 1099-MISC shows an amount in Box 7 for nonemployee compensation and its because you did consulting work or other services for someone you DO now have a business Youre in the business of consulting and you have to file Schedule C to report that 1099-MISC income. Claim the income as business income and write off any and all expenses associated with the job. If you have a 1099 NEC or 1099-MISC.

You may simply perform services as a non-employee. 124 for social security tax and 29 for Medicare. Social Security taxable wages are capped at a maximum each year.

Yes if you have 1099 income you are considered to be self-employed and you will need to pay self-employment taxes Social Security and Medicare taxes on this income. Not all 1099-NEC or 1099-MISC forms are from self-employment. The 1099-NEC Nonemployee Compensation is replacing the tax Form 1099-MISC Miscellaneous Income for self employed people starting the tax year 2020.

If you are self-employed a freelancer contractor or work a side gig and made 600 or more you will now receive Form 1099-NEC instead of Form 1099-MISC. You dont necessarily have to have a business for payments for your services to be reported on Form 1099-NEC. You dont necessarily have to have a business for payments for your services to be reported on Form 1099-NEC.

Any income appearing in box 7 of a 1099-MISC prior to 2020 is automatically considered to be self-employment income by the IRS. This is true even if you dont file a Schedule C. The good thing is that youre entitled to many tax deductions not available to W-2 employees such as writing off business expenses.

You are responsible for paying self-employment taxes on your miscellaneous income. Examples of income that are not from self-employment include prize money lawsuit settlement research study and others. Then click YES to indicate you have a 1099-MISC.

If payment for services you provided is listed on Form 1099-NEC Nonemployee Compensation the payer is treating you as a self-employed worker also referred to as an independent contractor. However the Internal Revenue. QuickBooks Self-Employed QBSE helps track your income expenses mileage and tax info.

Enter the 1099-MISC exactly as printed and then Continue. What is Non-Employee Compensation. Paying Taxes On Your Self-Employment Income The biggest reason why filing a 1099-MISC can catch people off guard is because of the 153 self-employment tax.

Reporting 1099-MISC box 3 or box 7 that is not self-employment income Under the Wages Income tab or Personal Income tab scroll down to Other Common Income and elect to startupdate Income from form 1099-MISC. If payment for services you provided is listed on Form 1099-NEC Nonemployee Compensation the payer is treating you as a self-employed worker also referred to as an independent contractor. As a self-employed taxpayer you must report your income the same as any other taxpayer.

This way you can add your contractors details and file their 1099-MISC forms to the IRS. This is a requirement not an option. Your tax liability rests on your shoulders.

That doesnt mean that lesser payments arent taxable but the client doesnt have to furnish a 1099 to the contractor. Although you can sign up to our E-file service standalone website. Most people who receive a 1099MISC for non-employee compensation are going to be considered self-employed by IRS standards.

Even if an individual is not formally issued a 1099 for contract work any non-employee payments for work should be included on an individual tax return. However creating 1099 forms for your contractors inside the program is unavailable. You may simply perform services as a non-employee.

The 1099 tax rate consists of two parts. Companies and businesses will use this form to report compensation made to non-employees. You may as well file the schedule C with your tax return and pay the self-employment tax.

No the taxpayer does not owe self-employment tax on amounts reported on the 1099-MISC she received from the insurance company if she is not engaged in a trade or business of providing care giving services as appears to be the case in this situation. This could be self-employment income and you would pay taxes on it on the conditions described above. For the self-employed aggregate payments over 600 require a 1099.

An Employer S Guide To Filing Form 1099 Nec The Blueprint

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

Does An S Corp Get A 1099 Misc Or 1099 Nec Infographic

What Is Irs Form 1099 Misc Kake

What Is Irs Form 1099 Misc Kake

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

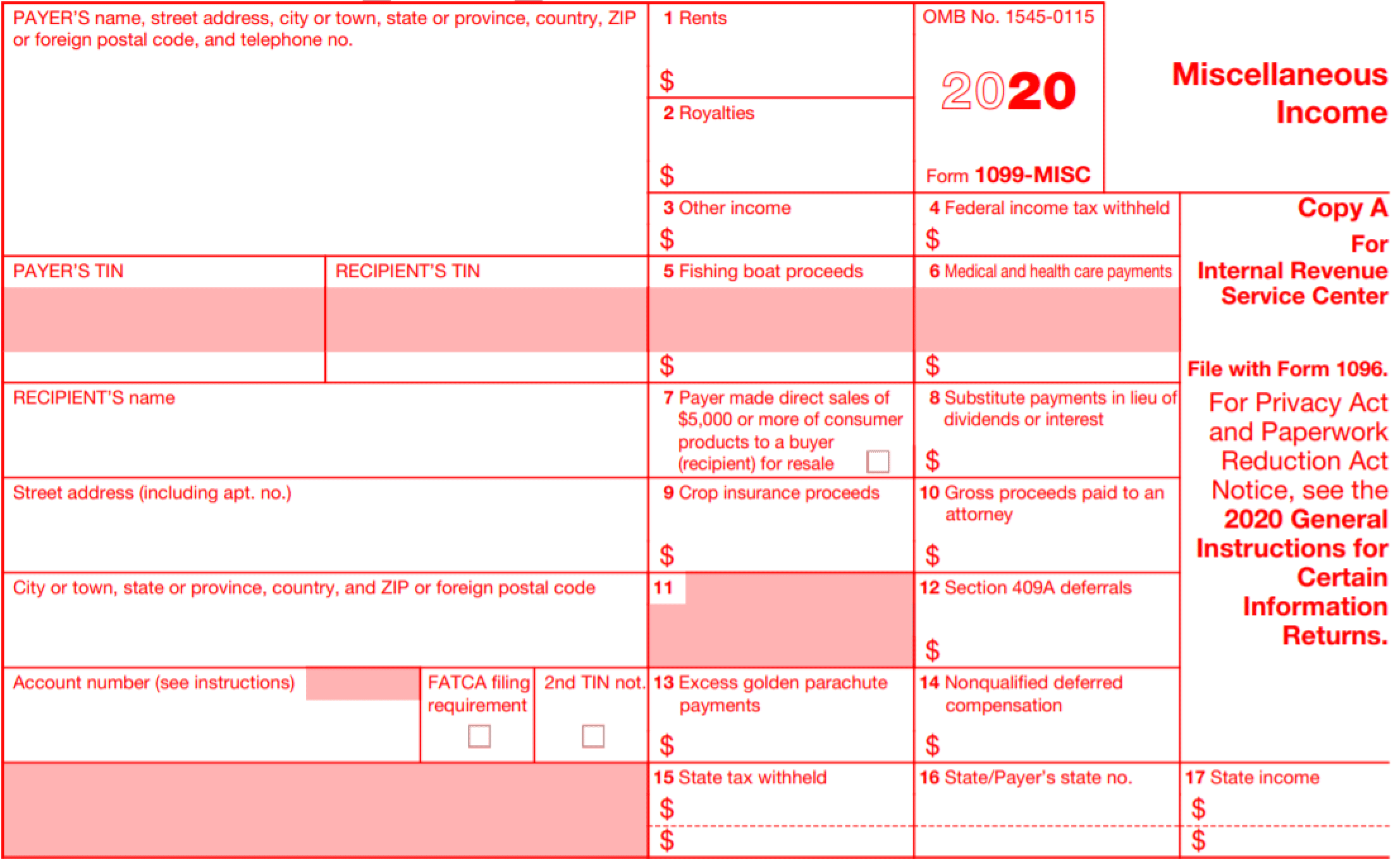

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

What Is The Difference Between Irs Form 1099 Nec And Form 1099 Misc

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Did You Receive A 1099 Misc But Aren T Self Employed Plano Tax Prep

Did You Receive A 1099 Misc But Aren T Self Employed Plano Tax Prep

What Is A 1099 Misc And How To Fill Out For Irs Pdfliner

What Is A 1099 Misc And How To Fill Out For Irs Pdfliner

Understanding Taxes Tax Tutorial Payroll Taxes And Federal Income Tax Withholding

Understanding Taxes Tax Tutorial Payroll Taxes And Federal Income Tax Withholding

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

W9 Vs 1099 Irs Forms Differences And When To Use Them

W9 Vs 1099 Irs Forms Differences And When To Use Them

How To Generate And Mail Your Own 1099 Misc Forms My Money Blog

How To Generate And Mail Your Own 1099 Misc Forms My Money Blog

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

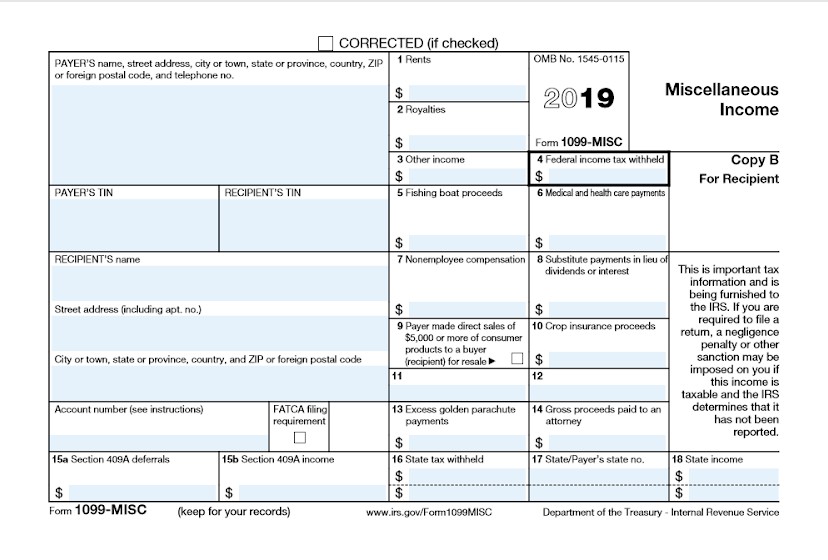

New Form 1099 Reporting Requirements For 2020 Atkg Llp

New Form 1099 Reporting Requirements For 2020 Atkg Llp

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

What If I Got A 1099 Misc With Only Box 7 Informat

What If I Got A 1099 Misc With Only Box 7 Informat