Small Business Gst Return Form

To request a new GST34-2 or GST34-3 call the Business Enquiries phone line at 1-800-959-5525. According to the Indian govt GST rules small businesses can file their returns online through Forms ITR-3 or ITR-4.

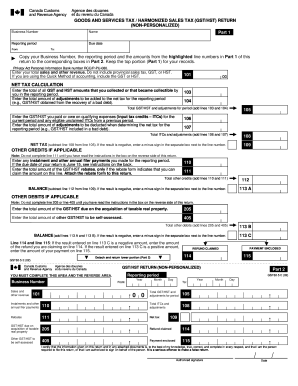

How To Complete A Canadian Gst Return With Pictures Wikihow

How To Complete A Canadian Gst Return With Pictures Wikihow

Each of the three Return Filing Forms has its own features based on which a Taxpayer.

Small business gst return form. Lodging your BAS or annual GST return. We issue your business activity statement about two weeks before the end of your reporting period which for GST is. The offline or manual filling is only allowed for certain taxpayers.

For the election to apply to the sale you have to be able to continue to operate the business with the property acquired under the sale agreement. There has been a sharp rise in the e-Invoicing mandated businesses wef April 1 st 2021 after the government decided to lower the aggregate turnover slab to 5 Cr to be eligible for e-Invoicing under GST. We will hold any GSTHST refund or rebate you are entitled to until we receive all outstanding returns and.

You have to file Form GST44 on or before the day you have to file the GSTHST return for the first reporting period in which you would have otherwise had to pay GSTHST on the purchase. File your GSTHST return Form GST34 File your combined GSTHST and QST return Form RC7200 File any applicable schedules with your return. 5 Crores less can opt for.

GST531 Return of Self-Assessment of the First Nations Goods and Services Tax FNGST Election and application forms available to all businesses or individuals GST10 Application or Revocation of the Authorization to File Separate GSTHST Returns and Rebate Application for Branches or Divisions. Form GST ANX-1 is one of the annexures that you need to file along with the main return GST RET-1 as a taxpayer under the New GST Return System. File certain rebates.

11 rows GST returns filing for startups GST return is a document that has to be filed. Due dates for filing a GSTHST return. Also small business does not require to pay Advance Tax four times a year.

To get a non-personalized version of the paper return Form GST62 use. This will be on top of the monthly returns and is to be filed by 31 st December of the next financial year. The Government is also set to extend the due dates of Goods and Services GST Return Filing for businesses for FY 2017-18 to December 31 2019 and for Financial Year 2018-19 to March 31 2020.

Instead they can pay the entire amount in one go by the 31st March of the relevant fiscal year. The personalized GSTHST return Form GST34-2 will show your due date at t he top of the form. GST RET-3 or Form Sugam is yet another main Return Filing Form that small Businesses having annual turnover of Rs.

Annual GST Return Filing Each business will have to file an annual return known as GSTR 9. The Government extended the dates for the following forms. Other forms may be appropriate for your specific type of business.

Electronic Data Interchange EDI File your GSTHST return Form GST34 File certain schedules with your return. Allows filer to submit payment at the same time. Most Canadian businesses must register to collect and pay the goods and services tax GST and harmonized sales tax HST on eligible itemsIf you are operating a Canadian business and registered for the GSTHST you can get back the GSTHST youve paid out during a particular reporting period by claiming it through input tax credits ITCs on your GSTHST return.

GST RET-3. If you are a recently self-employed Canadian or you are thinking about starting your own businessadding extra income with a side gig you may be curious about what the tax requirements and implications would be. The small businesses which are new to this provision are in a state of confusion and are developing a lot of myths about the e-Invoicing system.

Composite Taxpayer and GST Filing. The list should not be construed as all-inclusive. This Annexure contains the details pertaining to three important particulars including.

We can charge penalties and interest on any returns or amounts we have not received by the due date. This section provides links to a variety of forms that businesses will need while filing reporting and paying business taxes. Aside from the extra info youll include on your tax return you might also be required to register for a GSTHST account and become a GSTHST Registrant.

For example individuals with income less than Rs 5 lakhs and. Form GSTR-9 Annual Return Form GSTR-9C Reconciliation Statement. You should consult the instructions for each form for any related forms necessary to file a complete tax return.

Under the presumptive income scheme small businesses need to file the simplified return form called ITR-4 Sugam. To get a new access code for GSTHST NETFILE or GSTHST TELEFILE go to GSTHST Access Code Online. As per this new System the small taxpayers with an annual turnover of upto Rs 5 Crores in the previous financial year can choose to file quarterly returns in Form GST Sahaj Form GST RET-2 and GST Sugam Form GST RET-3.

Outward supplies including exports SEZ supplies deemed exports etc Inward supplies attracting Reverse Charge. The due date of your return is determined by your reporting period. You report and pay GST amounts to us and claim GST credits by lodging a business activity statement BAS or an annual GST return.

Quarterly Returns For Small Taxpayers Under Gst Summary Of Proposed Returns

Quarterly Returns For Small Taxpayers Under Gst Summary Of Proposed Returns

How To Complete A Canadian Gst Return With Pictures Wikihow

How To Complete A Canadian Gst Return With Pictures Wikihow

Gst Return Fill Online Printable Fillable Blank Pdffiller

Gst Return Fill Online Printable Fillable Blank Pdffiller

Gst Return Fill Online Printable Fillable Blank Pdffiller

Gst Return Fill Online Printable Fillable Blank Pdffiller

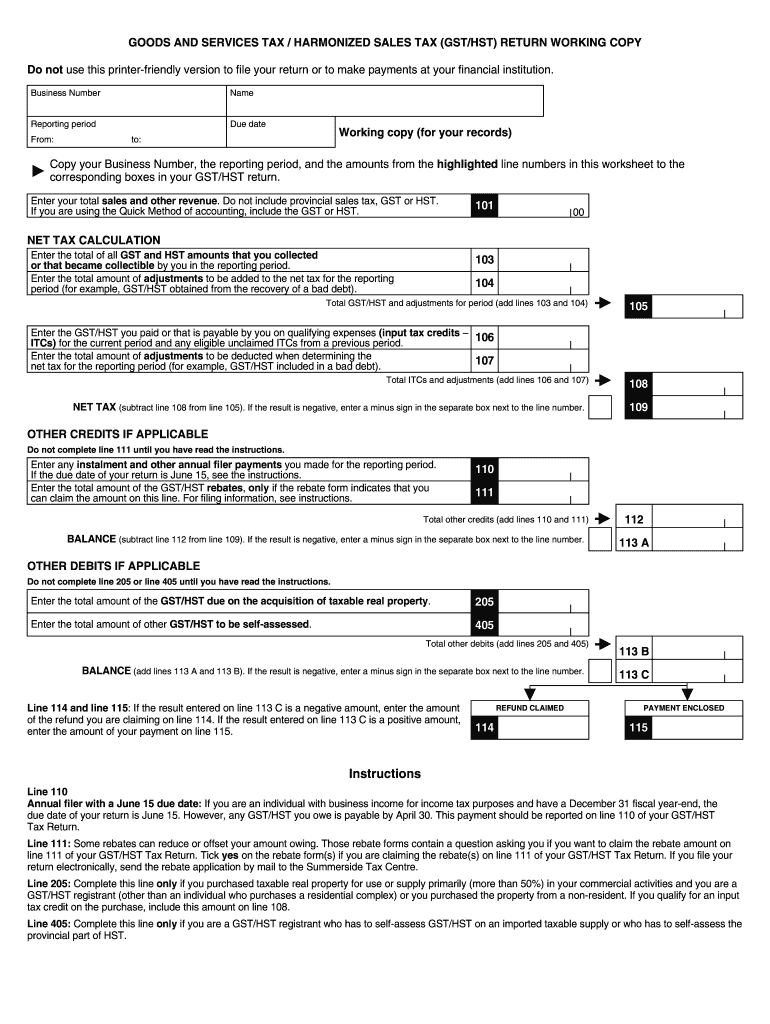

Hst Return Form Page 1 Line 17qq Com

Hst Return Form Page 1 Line 17qq Com

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

T5013 A Simple Guide To Canadian Partnership Tax Forms Bench Accounting

How To Complete A Canadian Gst Return With Pictures Wikihow

How To Complete A Canadian Gst Return With Pictures Wikihow

Homestead And Small Farm Tax Deductions Mother Earth News

Homestead And Small Farm Tax Deductions Mother Earth News

Sahaj Gst Return New Gst Return Filing Form Masters India Receipt Maker Bank Statement Paying Taxes

Sahaj Gst Return New Gst Return Filing Form Masters India Receipt Maker Bank Statement Paying Taxes

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Hst Return Form Page 1 Line 17qq Com

Hst Return Form Page 1 Line 17qq Com

How To Complete A Canadian Gst Return With Pictures Wikihow

How To Complete A Canadian Gst Return With Pictures Wikihow

Ca Gst Fill Online Printable Fillable Blank Pdffiller

Ca Gst Fill Online Printable Fillable Blank Pdffiller

2011 2021 Form Canada Gst62 E Fill Online Printable Fillable Blank Pdffiller

2011 2021 Form Canada Gst62 E Fill Online Printable Fillable Blank Pdffiller

Gst Return Fill Online Printable Fillable Blank Pdffiller

Gst Return Fill Online Printable Fillable Blank Pdffiller

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

3 11 106 Estate And Gift Tax Returns Internal Revenue Service

How To File Small Business Taxes Quickbooks Canada

How To File Small Business Taxes Quickbooks Canada

How To Complete A Canadian Gst Return With Pictures Wikihow

How To Complete A Canadian Gst Return With Pictures Wikihow

Hst Return Form Page 1 Line 17qq Com

Hst Return Form Page 1 Line 17qq Com