How To Structure A Small Business Buyout

Small-business owners with loyal employees who have expressed an interest in owning the company can engineer a buyout of their ownership stake in the company through the creation and funding of an. Use a small amount of equity and borrow the rest.

Best Guide On Corporate Finance Theory Practices Finance Accounting And Finance Finance Class

Best Guide On Corporate Finance Theory Practices Finance Accounting And Finance Finance Class

While leveraging assets can increase returns it does have a major disadvantage.

How to structure a small business buyout. When this happens there are two important goals which must be achieved. A buyer can acquire a business in two general ways. The choice is often determined by the size of the business and the number of employees.

There are several ways to structure the financing of your partnership buyout including lump-sum payments buyouts over time and earnouts. Generally speaking a buy sell agreement or a buyout agreement is a contract between all the partners in a business that deals with the future ownership of the business and partnership change. In a nutshell the full leverage buyout strategy is to arrange a loan with an asset based lender for the amount of the value of the assets in the company you want to buy effective immediately upon the moment you take ownership of that business.

Because a buyout agreement is a binding contract it can either stand by itself or it can be included inside of the partnership agreement. One common financing structure to buy a small business is a leveraged buyout. Structure the Payment If the partnership has the cash internally or has the cash flow and assets to qualify for loans it can do a lump sum buyout of the exiting partners.

Employees can own a business in various ways either directly or indirectly. Partnerships break up for many reasons. Preservation of the business 2.

There are a couple ways to structure an earn-out deal. Creating a formal buy-sell agreement from the start will mitigate risks that could hinder or even destroy your clients business down the. As a result post-closing AMIs capital structure consisted of debt and equity the owners.

To effectively execute a leveraged management buyout your business should possess the following characteristics. If the deal is well structured the business should generate enough cash flow to cover all regular business expenses in addition to the debt service from the buyout. These all involve debt financing which is.

You will both however need legal advice to work out a fair and suitable agreement. The private equity firm owned 80 of the company and the management group owned the remaining 20 of the company. Its the age-old concept of using leverage.

This structure can be an ideal way to reward your key employees position the company for growth and minimize or eliminate your ongoing financial risk. If other executives were integral to your companys growth and success will your company be able to function under new. The seller and buyer have another deal outside of the sale of the business where the seller is obligated to stay with the company for the next 2-3 years to help during the transition phase ie the Consulting clause in buy-sell contract.

A management team that is capable of operating and growing the business without. If the deal works. Leveraged buyouts allow buyers to maximize their returns by minimizing the cash they invest.

The first is where the buyer pays for the business at the closing of the deal. First he or she can buy company stock from shareholdersa stock sale Second he or she can buy the companys assets from the entity itselfan asset sale Tax and liability consequences vary depending on what exactly is bought. Keep the length of your contract as short as possible.

Keep your key players. The private equity group also helped arrange the debt financing for the deal having a financial sponsor partner often gives the lender more confidence in a management buyout structure. It sounds obvious but youll minimize the potential for.

One of the best ways to buy out a business partner is to self-fund the buyout. Some personal some financial some ego-driven. Here is a way to resolve this difficult transition safely and respectfully for both partners in a buyout situation.

In other words you pay the departing partner over time as if they were a lender and in this case you dont need anyone elses approval for the transaction. Preservation of the relationship. You then arrange for a swing loan at your bank.

For example a relatively small buyout might choose a co-operative model with an Industrial and Provident Society or a share company structure. How to Structure an Earn-out.

Shareholder Buyout Agreement Template Lovely Holders Agreement Template Business Letter Template How To Make Resume Contract Template

Shareholder Buyout Agreement Template Lovely Holders Agreement Template Business Letter Template How To Make Resume Contract Template

Sample Home Buyout Agreement Inspirational 18 Sample Buy Sell Agreement Templates Word Pdf Pages Business Owner Organization Cash Flow Statement Sample Resume

Sample Home Buyout Agreement Inspirational 18 Sample Buy Sell Agreement Templates Word Pdf Pages Business Owner Organization Cash Flow Statement Sample Resume

Types Of Business Organizations Structures Smallbusinessify Com Business Organization Small Business Start Up Business Articles

Types Of Business Organizations Structures Smallbusinessify Com Business Organization Small Business Start Up Business Articles

Explore Our Image Of Family Business Succession Plan Template For Free Succession Planning Small Business Plan Template Online Business Plan Template

Explore Our Image Of Family Business Succession Plan Template For Free Succession Planning Small Business Plan Template Online Business Plan Template

Buyout Agreement Template New 18 Sample Buy Sell Agreement Templates Word Pdf Pages Agreement Sample Resume Sample Resume Templates

Buyout Agreement Template New 18 Sample Buy Sell Agreement Templates Word Pdf Pages Agreement Sample Resume Sample Resume Templates

Why Is Business Important To Society 10 Reasons Smallbusinessify Com Small Business Success Start Up Business Small Business Start Up

Why Is Business Important To Society 10 Reasons Smallbusinessify Com Small Business Success Start Up Business Small Business Start Up

Shareholder Buyout Agreement Template Luxury Holders Agreement Contract Form Contract Template Rental Agreement Templates Name Badge Template

Shareholder Buyout Agreement Template Luxury Holders Agreement Contract Form Contract Template Rental Agreement Templates Name Badge Template

Buy Sell Agreement Template Form Legal Templates

Buy Sell Agreement Template Form Legal Templates

Free Buyout Agreement Form Printable Real Estate Forms Real Estate Forms Real Estate Templates Mortgage Agreement

Free Buyout Agreement Form Printable Real Estate Forms Real Estate Forms Real Estate Templates Mortgage Agreement

Shareholder Buyout Agreement Template Fresh Member Buyout Agreement Template Llc Holder Operating Templates Agreement Web Design Contract

Shareholder Buyout Agreement Template Fresh Member Buyout Agreement Template Llc Holder Operating Templates Agreement Web Design Contract

Why Is Business Important To Society 10 Reasons Smallbusinessify Com Small Business Success Business Help Coaching Business

Why Is Business Important To Society 10 Reasons Smallbusinessify Com Small Business Success Business Help Coaching Business

Buyout Agreement Template Elegant Sample Real Estate Agreement Form 8 Free Documents In Pdf Sample Resume Templates Templates Downloadable Resume Template

Buyout Agreement Template Elegant Sample Real Estate Agreement Form 8 Free Documents In Pdf Sample Resume Templates Templates Downloadable Resume Template

Fina4360 Nestle Follows An Aggressive Expansion Strategy By Conducting Acquisitions Mergers Merger The Expanse Leveraged Buyout

Fina4360 Nestle Follows An Aggressive Expansion Strategy By Conducting Acquisitions Mergers Merger The Expanse Leveraged Buyout

Buy Sell Agreement Template Form Legal Templates

Buy Sell Agreement Template Form Legal Templates

Business Financing Small Business Advice Business Funding Business Advice

Business Financing Small Business Advice Business Funding Business Advice

Types Of Business Organizations Structures Smallbusinessify Com Business Organization Small Business Start Up Side Business

Types Of Business Organizations Structures Smallbusinessify Com Business Organization Small Business Start Up Side Business

Structuring Your Trucking Company Transportation Grow Business How To Apply

Structuring Your Trucking Company Transportation Grow Business How To Apply

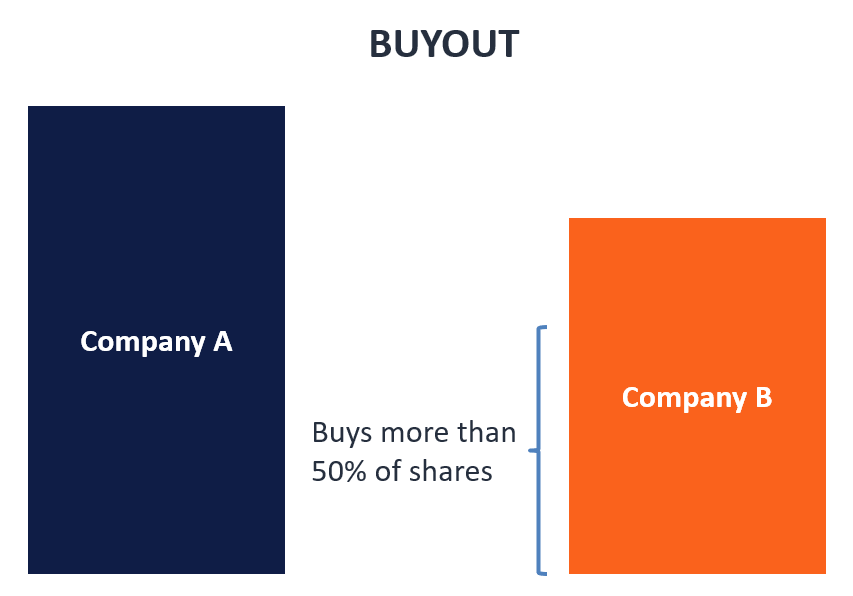

Buyout Overview Types Advantages And Disadvantages

Buyout Overview Types Advantages And Disadvantages

Browse Our Sample Of Equity Buyout Agreement Template For Free Resume Examples Templates Agreement

Browse Our Sample Of Equity Buyout Agreement Template For Free Resume Examples Templates Agreement