Do 1099 Independent Contractors Get Paid Overtime

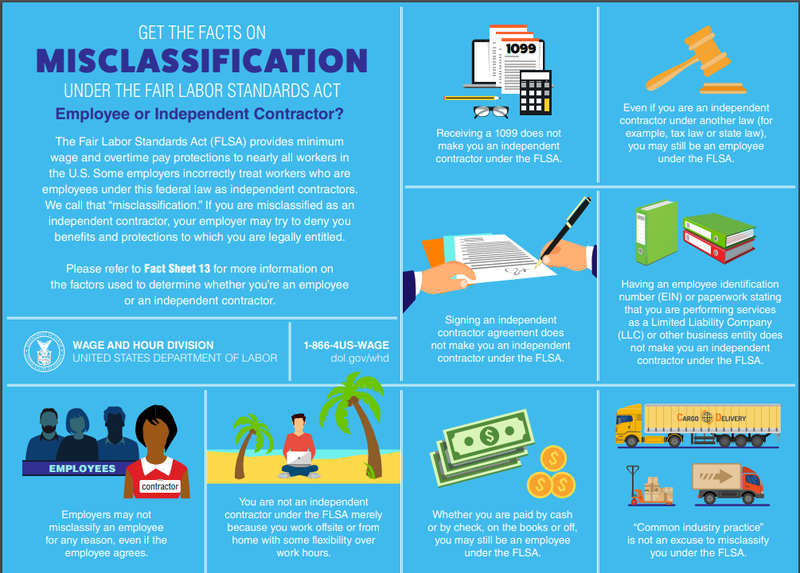

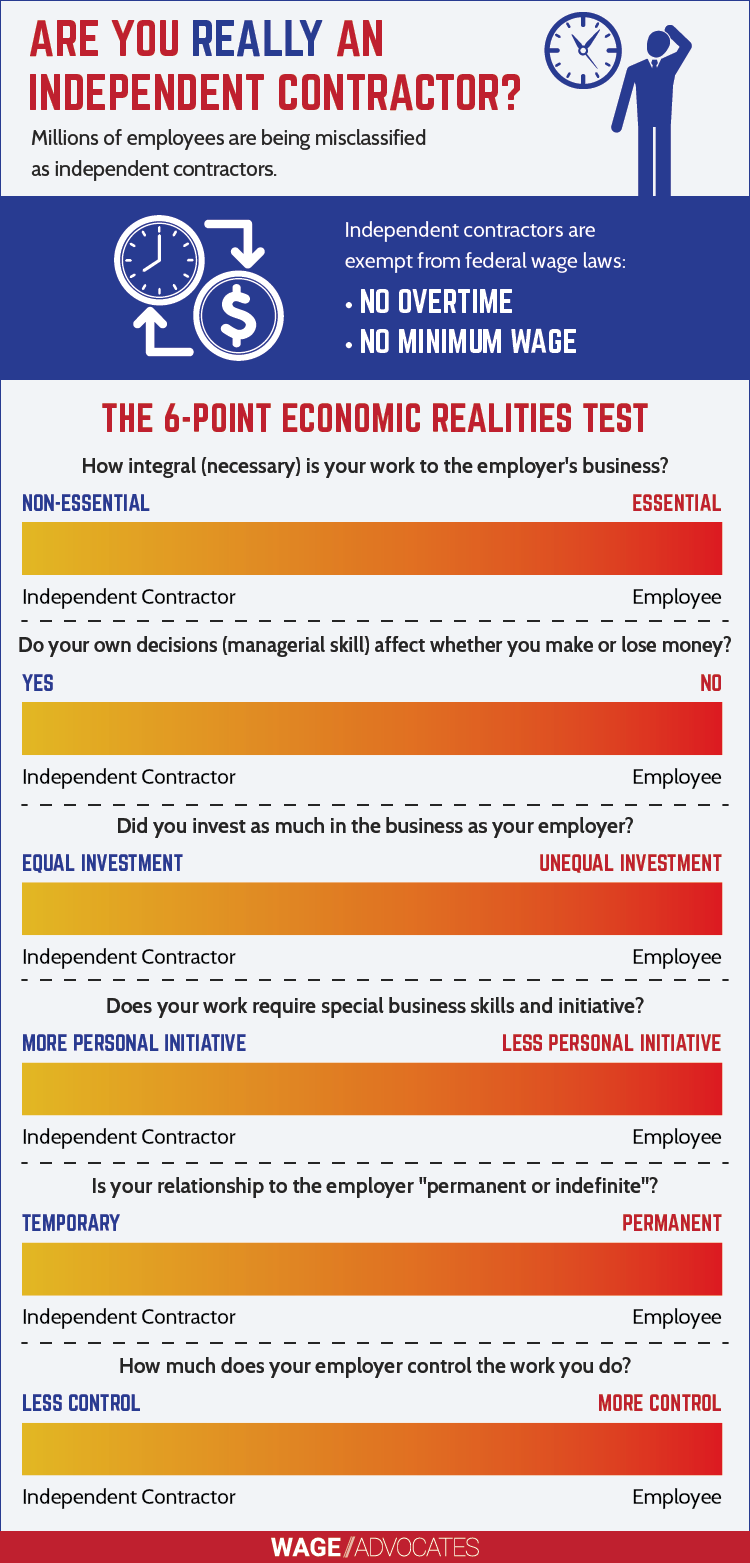

Avoiding the payment of time and a-half for hours worked over 40 per. Simply referring to a worker as a contractor or 1099 worker does.

Tennessee Independent Contractor Misclassification Lawyer

Tennessee Independent Contractor Misclassification Lawyer

Generally under the Fair Labor Standards Act everyone who works over forty 40 hours in a week is entitled to overtime pay.

Do 1099 independent contractors get paid overtime. Generally an employee may qualify for overtime if they perform non-administrative and executive tasks and earn less than 684 per week 35568 annually. Independent contractors are not entitled to overtime pay. As the name implies independent contractors also known as 1099 workers for the tax form they get instead of a W-2 must be legally separated from the company for which they perform work.

As the name implies independent contractors also known as 1099 workers for the tax form they get instead of a W-2 must be legally separated from the company for which they perform work. However these workers are often entitled to additional money for overtime work. This means no company-paid benefits no tax withholding no company payment of Social Security taxes and no right to overtime.

Employers often try to get around this law by classifying workers as independent contractors or 1099 employees. Labor Employment Law Litigation Corporate Business Law Attorney You have a great idea to avoid paying your workers overtime. California employees except for independent contractors and exempt employees are entitled to compensation for overtime.

The tax burden may come as a huge shock. Overtime for 1099 Independent Contractors Independent contractors are not entitled to overtime pay. Many of these workers who are filing as independent contractors for the first time may get a nasty surprise come April 17.

The DOL penalty for misclassifying employees as contractors can equal any overtime that should have been paid 15X normal wages for any hours over 40 worked in a week. Under the FLSA true independent contractors are not employees and are not eligible for overtime compensation. If you have previously been paid that helps establish the contract and you must document all previous payments and keep any tax documents like 1099.

As Tax Day approaches tens of millions of workers have received independent contractor tax forms or 1099s and their ranks are growing. Employees on the other hand are protected by these laws that require minimum wages and overtime pay. Classifying workers as independent contractors or 1099 employees substantially reduces payroll costs by avoiding paying employment taxes benefits and Overtime Pay.

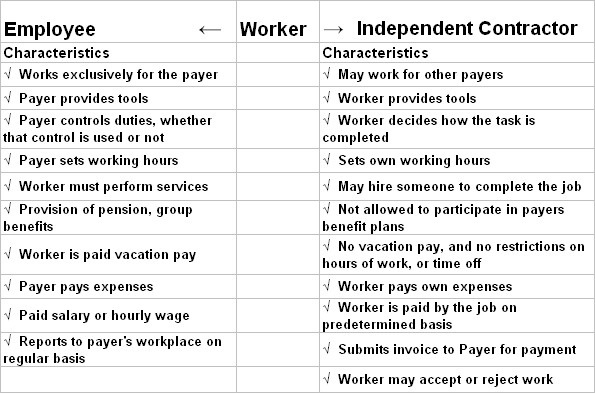

The Test for Overtime. Contractors are responsible for paying their own payroll taxes and submitting them to the government on a quarterly basis. Independent contractors use a 1099 form and employees use a W-2.

However some employers may misclassify you as an independent contractor yet in reality you are an employee. Independent contractors separate from contract employees do not get paid overtime. 8 hours in a workday.

Be sure to correctly classify employees to comply with DOL laws. Overtime pay is owed to employees who work over forty 40 hours in a workweek. Under the overtime laws you are entitled to pay if you work for more than.

If you dont get paid for your work as an independent contractor freelancer or business person begin by first writing to the business explaining the work you did and the payment you expect. For W-2 employees all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer. Plus courts can award an additional 100 of unpaid overtime payments.

However it is a common practice for employers to intentionally misclassify employees who should be paid on a w-2 basis as independent contractors paid on a 1099 basis. Not surprisingly the number one reason companies treat workers as independent contractors even when they are legally employees is MONEY. Many persons are misclassified as independent contractors but are actually employees under federal state and Illinois law for purposes of the overtime pay laws.

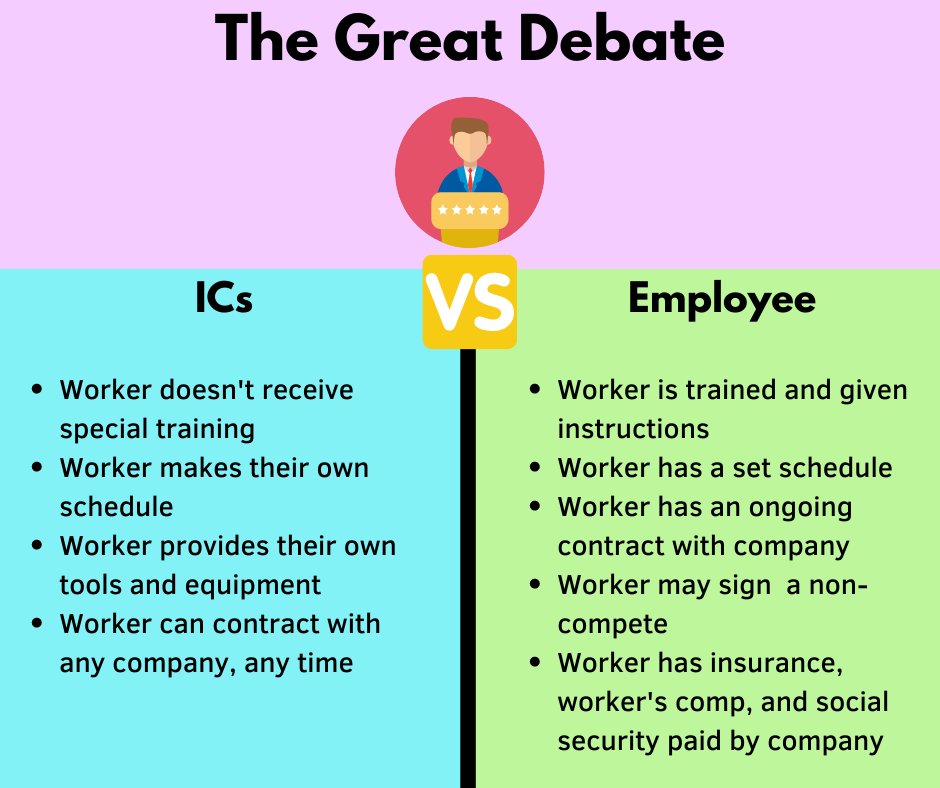

Independent contractors are not covered. Have the workers sign independent contractors agreements pay. There is a significant difference between 1099 workers and employees.

Independent contractors are not eligible for overtime as they exercise control over the number of hours and days in which they work. Overtime for 1099 Independent Contractors The matter of classification of employees as independent workers and not employees is a move by employers to seek tax benefits at the expense of employees. By classifying employees as independent contractors employees receive 1099 tax forms as opposed to W-2s tax forms used by employees.

For independent contractors the California employment law and the Fair Labor Standards Act does not apply to them meaning they do not get overtime pay. As a result employers have a significant economic incentive to misclassify employees as independent contractors. As employees included on payroll nonexempt contract employees receive overtime.

This means that independent contractors do not have to be paid time and a half for working overtime. 1099 workers ie. Only non-exempt employees misclassified as 1099 contractors are eligible to claim unpaid overtime.

In such a scenario you will be entitled to overtime. This means no company-paid benefits no tax withholding no company payment of Social Security taxes and no right to overtime. Independent contractors are not on the businesss payroll or the payroll of a separate W-2 employer of record.

Independent Contractors Vs Employees A Guide For Pet Sitters And Dog Walkers Time To Pet

Independent Contractors Vs Employees A Guide For Pet Sitters And Dog Walkers Time To Pet

Employee Or Independent Contractor Getting It Right

Employee Or Independent Contractor Getting It Right

Can 1099 Independent Contractors Receive Overtime Pay Workers Compensation Attorney

Can 1099 Independent Contractors Receive Overtime Pay Workers Compensation Attorney

Small Business Tax Preparation For Independent Contractors

Protect Your Business With An Independent Contractor Agreement Legalzoom Com

Protect Your Business With An Independent Contractor Agreement Legalzoom Com

Avoid Misclassification Understand Independent Contractors Abacus Payroll

Consultant Independent Contractor Agreements Legal Books Nolo

Consultant Independent Contractor Agreements Legal Books Nolo

A Small Business Guide To Independent Contractors The Blueprint

A Small Business Guide To Independent Contractors The Blueprint

Overtime Pay Guide For The Independent Contractor

Overtime Pay Guide For The Independent Contractor

Converting From Contractor To Employee How To

Converting From Contractor To Employee How To

Independent Contractor Taxes Priority Hr

Employee Vs Independent Contractor What S The Difference

Employee Vs Independent Contractor What S The Difference

Independent Contractors And Overtime Pay Worker Employment Overtime Pay Rights

Independent Contractors And Overtime Pay Worker Employment Overtime Pay Rights

Printable Independent Contractor Profit And Loss Statement Template Pdf In 2021 Statement Template Incentives For Employees Profit And Loss Statement

Printable Independent Contractor Profit And Loss Statement Template Pdf In 2021 Statement Template Incentives For Employees Profit And Loss Statement

How To Manage 1099 Sales Reps Independent Contractors Professional Insurance Independent Contractor Sales Rep

How To Manage 1099 Sales Reps Independent Contractors Professional Insurance Independent Contractor Sales Rep

The Pros And Cons Of Hiring Independent Contractors

The Pros And Cons Of Hiring Independent Contractors

Company And Company Owner Liable For Flsa Violations Workers Not Independent Contractors

Company And Company Owner Liable For Flsa Violations Workers Not Independent Contractors

Can 1099 Independent Contractors Receive Overtime Pay Workers Compensation Attorney

Can 1099 Independent Contractors Receive Overtime Pay Workers Compensation Attorney

Employee Classification How Do I Classify My Brokers As Independent Contractors Or Employees Chicago Association Of Realtors