Do I Send 1099s To Foreign Companies

Unless the recipient is subject to reporting 1099 income to the US. If the foreign contractor is not a US.

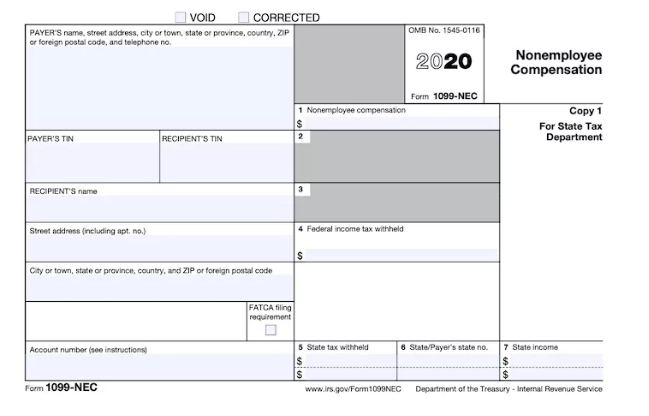

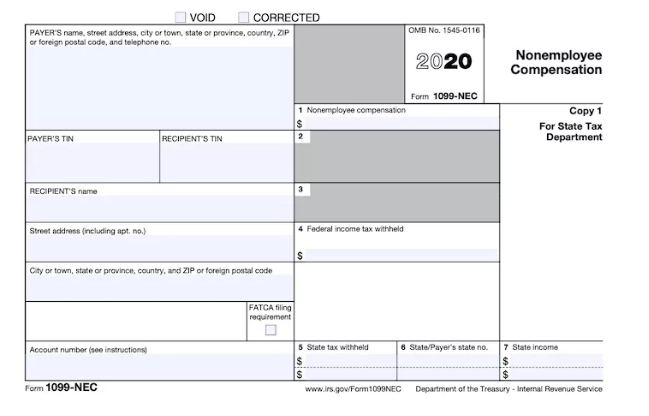

Change To 1099 Form For Reporting Non Employee Compensation Ds B

Change To 1099 Form For Reporting Non Employee Compensation Ds B

Rules for Foreign Workers.

Do i send 1099s to foreign companies. A payment to a foreign account is presumed to be made to a US. In addition to issuing 1099-MISCs to all applicable companies businesses must also issue 1099-Bs to any companies foreign or domestic. If your independent worker completes all tasks in hisher country of origin and receives compensation via PayPal a Form 1099 is also not necessary.

Real property interest is acquired from a foreign person see Pub. It is the onus of the business owner to determine whether a contractor or vendor is a citizen. If the company submits a 1099 form to the IRS but for some reason see below you dont receive it the IRS will send you a letter actually a bill saying you owe taxes on the income.

Self-employed via internet - For businesses hiring foreign individuals for work remotely or over the internet a Form 1099 is not required. If the following four conditions are met you must generally report a payment as nonemployee compensation. No Form 1099 then needs to be filed for payments to foreign persons.

You can ask them to fill out Form W-8BEN for this purpose. Financial institution if the foreign branch is a qualified intermediary Any other person that is not a US. Taxpayer and all of the contracted services were performed outside the US a Form 1099 is not required.

All that the foreign contractor needs to do is to complete the basic information in Part I and sign in Part III attesting that the information is true correct and complete. Payments to Foreign Accounts. A 1099 is required for any worker who is not a US.

Foreign worker providing services inside the US-. The Form W-8BEN certifies that the foreign contractor is not a US. So you dont have to complete 1099s for non-US.

Nonresident alien individual Foreign corporation or partnership Foreign trust or estate Foreign government Foreign branch of a US. However they are not specific about foreign entities on that form. However foreign corporations are not issued this document.

I am paying more than 600month. Any person making more than 600 per year is issued a 1099-MISC for income earned in the US. Do I Form 1099 Report a Puerto Rican Payee Doing Work in Puerto Rico.

Instead you will need to ask the contractor to complete a Form W-8BEN. And who are also citizens of the country. A 1099 is normally issued to individuals living in the US.

Non-exempt you do not need to report payments to them on a. Thus the payor must file a Form 1099 for the payee but the payment is not subject to backup withholding. Sales or exchanges involving foreign transferors are reportable on Form 1099-S.

As long as the foreign contractor is not a US. By signing Form W-8BEN the foreign contractor is certifying that he or she is not a US. 515 Withholding of Tax on Nonresident Aliens and Foreign Entities.

You should get a form W-8BEN signed by the foreign contractor. You only issue 1099s to non-corporate entities contractors consultants some LLPs and similar entities - read the specifics on the form that are US. Do I have to issue a 1099 to a foreign company that is providing service to my US based LLC sole-proprietorship.

For information on the transferees responsibility to withhold income tax when a US. However in the US. My understanding is that companies incorporated in PR are considered foreign but individuals for tax purposes are considered US residents.

If you pay independent contractors you may have to file Form 1099-NEC Nonemployee Compensation to report payments for services performed for your trade or business. Person and the services are wholly performed outside the US then no Form 1099 is required and no withholding is required.

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

The Company Need To E File 1099 Int Form To Show The Interest To The Irs Http Www Onlinefiletaxes Com Income Tax Bookkeeping Services Accounting Services

The Company Need To E File 1099 Int Form To Show The Interest To The Irs Http Www Onlinefiletaxes Com Income Tax Bookkeeping Services Accounting Services

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Do I Have To Prepare A 1099 Nec For A Foreign Contractor Amy Northard Cpa The Accountant For Creatives

Do I Have To Prepare A 1099 Nec For A Foreign Contractor Amy Northard Cpa The Accountant For Creatives

Filing 1099s Who Gets One Capforge

Filing 1099s Who Gets One Capforge

Form C S Is An Abridged 3 Page Income Tax Returns Form For Eligible Small Companies To Report Their Income To Singapore Business Business Infographic Tax Forms

Form C S Is An Abridged 3 Page Income Tax Returns Form For Eligible Small Companies To Report Their Income To Singapore Business Business Infographic Tax Forms

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Form 1099 Nec Requirements Deadlines And Penalties Efile360

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Efile

1099 Int Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Efile

1099 Form 2016 News Irs Forms 1099 Tax Form Tax Forms

1099 Form 2016 News Irs Forms 1099 Tax Form Tax Forms

Interest Income Form 1099 Int What Is It Do You Need It

Interest Income Form 1099 Int What Is It Do You Need It

1099 Misc Form 2017 Tax Forms Templates Form

1099 Misc Form 2017 Tax Forms Templates Form

Do You Want To Track Your 1099 Payments In Wave Accounting Yes You Say Well Here Is A Blog Post Just Fo Wave Accounting Business Read Bookkeeping Software

Do You Want To Track Your 1099 Payments In Wave Accounting Yes You Say Well Here Is A Blog Post Just Fo Wave Accounting Business Read Bookkeeping Software

What The Heck Is Irs Form 1099 S And Why Does It Matter Value Statement Examples Business Case Template Irs Forms

What The Heck Is Irs Form 1099 S And Why Does It Matter Value Statement Examples Business Case Template Irs Forms

Irs Form 1099 R What Every Retirement Saver Should Know Fox Business Irs Forms Retirement How To Plan

Irs Form 1099 R What Every Retirement Saver Should Know Fox Business Irs Forms Retirement How To Plan

Understanding Your Tax Forms 2016 1099 Misc Miscellaneous Income Tax Forms Doctors Note Template Important Life Lessons

Understanding Your Tax Forms 2016 1099 Misc Miscellaneous Income Tax Forms Doctors Note Template Important Life Lessons

Do I Need To File 1099s Deb Evans Tax Company

Do I Need To File 1099s Deb Evans Tax Company

Downloadable 1099 Tax Forms Printable 1099 Form 2018 Word Image 510 Printable Pages 1099 Tax Form Business Letter Template Simple Cover Letter Template

Downloadable 1099 Tax Forms Printable 1099 Form 2018 Word Image 510 Printable Pages 1099 Tax Form Business Letter Template Simple Cover Letter Template