How To Get A Loan As A 1099 Employee

How do you handle issuing 1099s of loan amounts to ees if they have a multiyear forgiveness schedule. Whether youre self-employed or a 1099 employee you can still get an auto loan.

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

If you havent yet filed a Schedule C you must complete one and submit it with your 1099-MISC.

How to get a loan as a 1099 employee. 1099 the full amount in year paid or 1099 the amount forgiven. Your boss can apply for PPP because he has employees you and you can separately get your own PPP based on your 1099self-employed earnings. But because you arent a regular W-2 employee auto lenders want to see some extra documents.

On the face of it the process seems quite simple on how the loan. I logged into my Fedloan account to get my student loan tax info last night as my final loan out of an original 12 was paid off in May of 2020. The answer is negative.

Submit your best application and remember that stronger applications get better loan offers. 1099 wage earners need two years seasoning as being 1099 wage earners in order to qualify for a mortgage On the flip side if you are a W-2 employee and have been a W-2 employee for the past 30 days you can qualify for a mortgage You need to provide the offer letter of employment. I then saw that 8 of my 12 original loans all of which had been listed as PAID IN FULL and had been listed as 0 dollars balance some of which for nearly 2 years suddenly had a small balance each.

You should let your contractors and other 1099 workers know that they can and should apply directly with Womply for their own PPP loans. How to calculate your PPP loan forgiveness as a self-employed individual without employees. They file their taxes using 1099 forms as opposed to employees which use W-2s.

Gig workers you can now qualify for more money from a Paycheck Protection Program PPP loan. If they determine that you may qualify for a PPP loan they will assist you with putting together your PPP Loan application and then submit it to a lender in their network that make be offering PPP loans at that time. If a W-2 wage earner goes to a 1099 wage earner status then two years of 1099 income is required from the start date of the 1099 wage earner status date.

1099 wage earners who need to qualify for a mortgage loan borrowers need a two-year history as a 1099 wage earner. How 1099 Workers Should Apply for Stimulus Loans The Treasury Department finally clarified how self-employed individuals can get Paycheck Protection Program loans-. More specifically there arent financing options that are specially created for 1099 workers.

A color copy of your Drivers License front and back A voided check for your business bank account. Add both line 7s together if you want to check for a 25 reduction. Define your net income as listed on your Form 1040 Schedule C if its more than 100000 then you must reduce it to 100000 b.

Your first step in trying to secure a loan should be to check with your current bank or lending institution to see. Paying workers with a 1099 is NOT having employees. Nevertheless there are numerous loans that 1099 workers might qualify for and this applies to visa holders that have the status of 1099 workers as well.

Its free to apply and it could mean thousands of. Divide net income by 12 to get payroll costs even if you dont have a. 2019 Schedule C which is now required.

1099 Wage Earners Versus W-2 Wage Earners. Our partner will review this initial request. How to Use a Stilt Loan for a Down Payment on Your Mortgage.

How to Obtain Loan Forgiveness. Heres how to apply with Womply. Receiving other forms of income eg from an employer or passive income source or investments does not disqualify you from getting a PPP loan.

You work for a company as an employee and get a W2 tax form for employees and separately work via a 1099 or are otherwise Self-Employed. What Documents Do 1099 Employees Need to Apply for a PPP Loan. Yes if you had ANY 1099 or other self-employed income in 2019 or 2020 you should definitely apply for a PPP loan.

Apply online for the loan amount you need. When youre looking to prequalify for a mortgage and the majority of your income is as a 1099 independent contractor lenders will evaluate your. You add the amount of the forgiven loan to their W-2 box 1 income each year and deduct the appropriate payroll tax employer share of FICA and medicare tax as well as federal and state withholding.

1099 Income Loan Program Mortgage Solutions For Self Employed Borrowers Angel Oak

1099 Income Loan Program Mortgage Solutions For Self Employed Borrowers Angel Oak

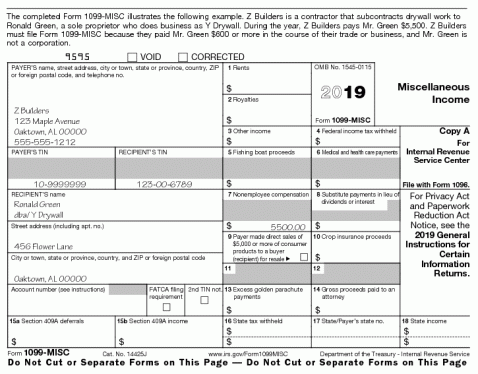

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

![]() 1099 Employee What To Know Before Hiring An Indpenednt Contractor

1099 Employee What To Know Before Hiring An Indpenednt Contractor

What Is A 1099 Employee The Definitive Guide To 1099 Status Supermoney

What Is A 1099 Employee The Definitive Guide To 1099 Status Supermoney

Fha Loan With 1099 Income Fha Lenders

Fha Loan With 1099 Income Fha Lenders

![]() Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec For Nonemployee Compensation H R Block

![]() 1099 Employee What To Know Before Hiring An Indpenednt Contractor

1099 Employee What To Know Before Hiring An Indpenednt Contractor

What Is A 1099 Form Everything You Need To Know About This Tax Document Student Loan Hero

What Is A 1099 Form Everything You Need To Know About This Tax Document Student Loan Hero

![]() 1099 Employee What To Know Before Hiring An Indpenednt Contractor

1099 Employee What To Know Before Hiring An Indpenednt Contractor

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

How To Get Your Employment Or Income Verification At Uber

How To Get Your Employment Or Income Verification At Uber

![]() 1099 Employee What To Know Before Hiring An Indpenednt Contractor

1099 Employee What To Know Before Hiring An Indpenednt Contractor

How To Get Ppp Loans If You Re Self Employed Austin Business Journal

Top 25 1099 Deductions For Independent Contractors

Top 25 1099 Deductions For Independent Contractors

Reporting 1099 Misc Box 3 Payments

Reporting 1099 Misc Box 3 Payments

![]() Looking To Hire W2 Vs 1099 Which Is Best For Your Business

Looking To Hire W2 Vs 1099 Which Is Best For Your Business

1099 Employee What To Know Before Hiring An Indpenednt Contractor

1099 Employee What To Know Before Hiring An Indpenednt Contractor

![]() 1099 Employee What To Know Before Hiring An Indpenednt Contractor

1099 Employee What To Know Before Hiring An Indpenednt Contractor